GST/QST Calculator

See:

What is Quebec Sales Tax (QST)?

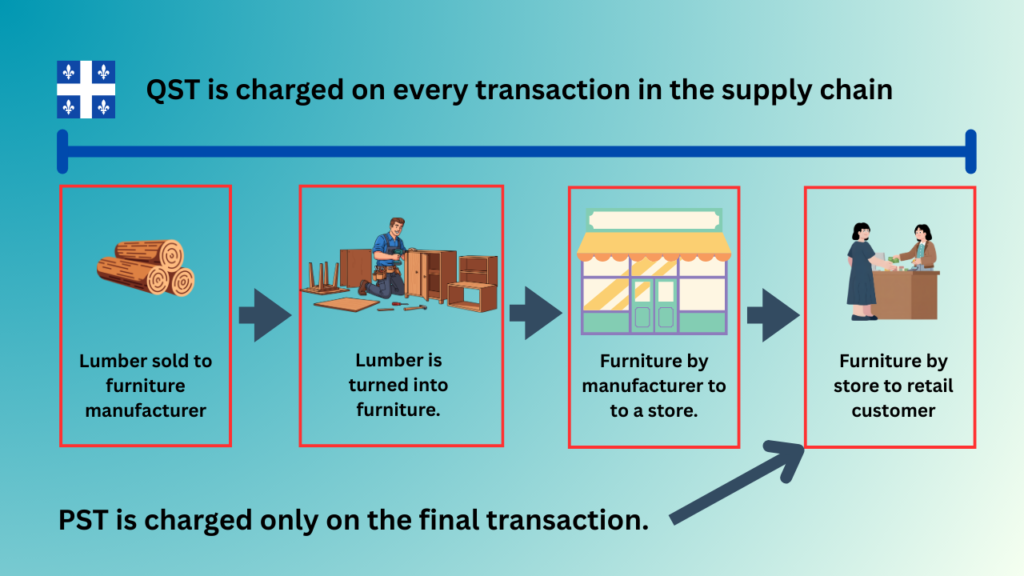

Quebec sales tax is the total sales tax you pay in Quebec, made up of a federal part (GST) and a provincial part (QST). Unlike PST or HST in other provinces, Quebec charges QST at every stage of the supply chain, though businesses can reclaim the tax on their purchases. For example, a furniture maker pays QST when buying wood, and the store charges QST again when selling the finished furniture to a customer. In contrast provinces that charge PST only charge it on the final retail sale to the customer.

Quebec rebates and exemptions to the QST

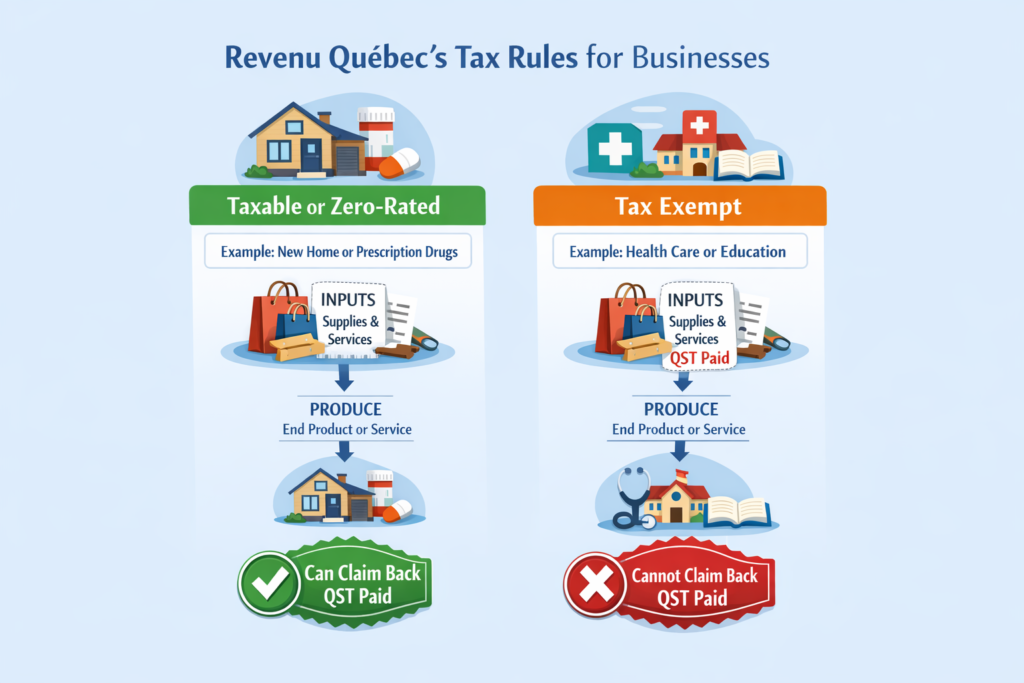

Revenu Québec classifies all goods and services into one of three categories: taxable, zero-rated, or tax-exempt. A business must charge tax on any product or service that is taxable.

However, if a product or service is taxable or zero-rated, for example, a newly built home or a prescription drug, the business can claim back the QST it paid on the goods and services needed to produce it. By contrast, if the end product or service is tax-exempt, all the inputs are still subject to QST, and the business cannot recover the tax paid on them.

For the official list of taxable, zero-rated and tax exempt products and services, click on the links below.

- Taxable Supplies — Revenu Québec (GST/QST)

- Zero‑Rated Supplies — Revenu Québec (GST/QST)

- Exempt Supplies — Revenu Québec (GST/QST)

How much tax do you pay on a used car in Quebec?

If you buy a used car in Quebec, the amount of QST and GST that you pay when you depends on who you buy the car from.

- If you buy from a dealership: You will pay 5% federal GST and 9.975% QST. The dealership will collect the GST when you buy the vehicle and you will pay the QST to SAAQ (Société de l’assurance automobile du Québec) when you register the vehicle and the dealer will provide you with the details of what you must pay. The GST is calculated based on the purchase price from the dealer whereas, the QST is calculated based on the greater of the purchase price and the estimated value of the vehicle (unless the vehicle has been subject to unusual wear and tear).

- If you buy from a private seller: You will pay the 9.975% QST and no GST. You pay the QST to the SAAQ (Société de l’assurance automobile du Québec) when you register the vehicle.

For more information on this, read Purchase of a used vehicle from a dealer.

Quebec sales tax on new and substantially renovated homes

When you buy a new or substantially renovated home in Quebec, you must pay both the federal GST (5%) and the provincial QST (9.975%) on the purchase price.

There are rebate programs that can reduce part of the tax you pay on new and substantially renovated homes, for more information on this read GST/QST New Housing Rebate in Quebec (2026).

Special Taxes on Insurance Premiums

In Quebec, certain insurance policies carry additional provincial taxes on top of your base premium. These special taxes apply to auto, home, and some life insurance policies, and are collected by your insurer and remitted to Revenu Québec (so there is nothing extra for you to do). For example, a $1,000 homeowners policy with a 9% special tax would be charged as follows.

| Component | Rate | Calculation | Amount |

|---|---|---|---|

| Base Premium | – | – | $1,000 |

| Special Tax | 9% | 1,000 × 9% | $90 |

| Subtotal | – | 1,000 + 90 | $1,090 |

| GST | 5% | 1,090 × 5% | $54.50 |

| Subtotal | – | 1,090 + 54.50 | $1,144.50 |

| QST | 9.975% | 1,144.50 × 9.975% | $114.15 |

| Total Premium | – | – | $1,258.65 |

Quebec First Nations and QST

Goods and services sold on a First Nations reserve may be exempt from GST and QST, but the exemption depends on specific conditions. In general, the purchaser must be a Status Indian, a band, or a band-empowered entity, and the transaction must take place on the reserve. For instance, tangible goods must be delivered to a purchaser on the reserve and services must be performed on the reserve.

If these conditions are not met, such as when goods are picked up off-reserve or services are performed elsewhere, the taxes typically apply, even if the purchaser is otherwise eligible.

Government of Canada’s and Revenu Québec websites.

Quebec rebates and exemptions to the GST

GST uses the same categories as the Quebec Sales Tax (QST) i.e.:

| GST type | GST charged to buyer? | Business can reclaim GST paid on inputs? |

|---|---|---|

| Taxable | Yes | Yes |

| Zero-rated | No | Yes |

| Exempt | No | No |

The government of Canada provides an official list of taxable, zero-rated and tax exempt products and services.