Finding a safe and independent living space for a senior or an adult with a disability is challenging.

Long-term care facilities and retirement homes can cost tens of thousands of dollars per year, while living alone can lead to isolation and loneliness. Many families want to keep loved ones at home, but also ensure they have privacy, independence, and dignity.

Canada’s multigenerational tax credit helps address these challenges by allowing eligible homeowners to claim up to $7,500, when creating a self-contained unit for a senior or adult with a disability. This can allow loved ones to stay close to family, enjoy daily support and companionship, and maintain independence under the same roof.

In this article, we explain who qualifies, which renovations are eligible, and how to claim the credit in 2026:

- What is the multigenerational tax credit?

- How much is Canada’s multigenerational tax credit?

- Who is eligible for the CRA multigenerational tax credit?

- How to apply for Canada’s multigenerational tax credit?

- Final remarks

What is the multigenerational tax credit?

Canada’s multigenerational tax credit helps families renovate their existing home to create a self-contained, private living area for a senior aged 65 or older or an adult eligible for the Disability Tax Credit.The renovated space must allow the individual to live independently and typically includes its own entrance, kitchen or kitchenette, bathroom, and sleeping area.

Officially called the multigenerational Home Renovation Tax Credit (MHRTC), the program helps seniors and adults with disabilities live independently and with dignity. As such, to be eligible you must create a private, self-contained living space for a qualifying individual. You cannot simply add a new room within a shared space. For example, you could create a basement apartment with its own separate entrance, but you could not simply add a bedroom or bathroom to an existing shared living space.

How much is Canada’s multigenerational tax credit?

Under Canada’s multigenerational tax credit, eligible homeowners are able to claim a 15% non-refundable tax credit of up to $50,000 of qualifying renovation expenses. This results in a maximum tax credit of up to $7,500 (or 15% of $50,000).

For example, let’s suppose you decide to add a basement apartment with its own entrance, kitchen, bathroom, and sleeping area for a qualifying senior or adult with a disability. If you spend $50,000 on the renovation (including taxes), you can claim a tax credit of $7,500, or 15% of the total cost.

Note:

Who is eligible for the CRA multigenerational tax credit?

The CRA multigenerational tax credit applies when you renovate a home to add a self-contained secondary unit for a senior aged 65 or older, or an adult (18+) who is eligible for the Disability Tax Credit (DTC). The senior or eligible adult must be related to the homeowner in one of the following ways:

- Parent or step-parent

- Grandparent or step-grandparent

- Child or step-child

- Grandchild or step-grandchild

- Sibling or step-sibling

- Other relatives living in the same household (depending on CRA interpretation, but generally direct family relationships are safest)

Note:

What renovations qualify?

Not all types of renovations qualify for Canada’s multigenerational tax credit. In fact, the CRA allows you to claim the tax credit for certain renovation expenses when you create a self‑contained secondary unit within your home. The CRA defines a secondary unit as a self‑contained housing unit with a private entrance, kitchen, bathroom, and sleeping area, either newly built or converted from an existing space that did not previously meet local requirements for a secondary dwelling.

For example, you could renovate a basement to create an apartment with its own entrance, kitchen or kitchenette, bathroom, and sleeping area for a qualifying senior or adult with a disability. You could not, however, simply add a bedroom or bathroom to an existing shared living space and claim the credit.

What expenses are eligible?

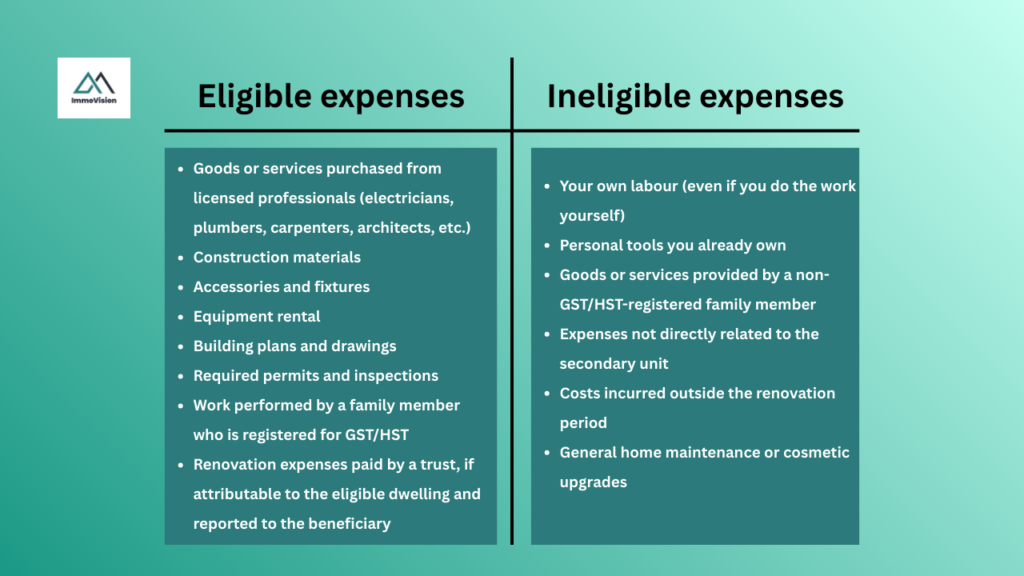

As you modify your home, you will incur expenses on contractors and/or materials that you will buy in order to complete the renovation work. Not all of these expenses will be eligible for the CRA multigenerational tax credit. The CRA guidelines state that eligible expenses must be:

- Reasonable and directly attributable to the qualifying renovation that creates the separate living unit.

- Paid or incurred during the renovation period (after December 31, 2022).

- Supported by receipts and documentation.

While the CRA does not provide a complete list of included and excluded expenses, it does offer examples of eligible and ineligible costs. You can see these examples in the graphic below.

When can you claim it?

To claim the Multigenerational Home Renovation Tax Credit (MHRTC), you must calculate and report your eligible renovation expenses on your personal income tax return in the year the renovation period ended. The CRA defines the “renovation period” as starting when you make the first qualifying expenditure (when the work officially begins) and ending when you complete the final renovation work. This is the case even if the work takes longer than a year. You must report all eligible expenses on Schedule 12 of your personal tax return to claim the tax credit.

Note:

Does Québec offer a similar credit?

As of now, Québec does not offer a separate provincial multigenerational renovation tax credit. However, if you are living in Québec, you can still apply for the federal MHRTC. There are also other Québec renovation or home-support programs, such as grants for accessibility modifications, energy-efficiency renovations, or municipal home improvement programs. You may wish to explore these options to see if your project qualifies for additional financial support.

How to apply for Canada’s multigenerational tax credit?

To apply for Canada’s multigeneraional tax credit, we recommend that you take the following steps.

- Complete your eligible renovations

Make sure the work creates a self-contained, private living unit for a senior (65+) or an adult eligible for the Disability Tax Credit (DTC). Keep all receipts, invoices, and documentation for materials, labour, permits, and other eligible expenses. - Calculate your eligible expenses

Add up all qualifying costs related to creating the secondary unit. Remember, the maximum eligible expenses are $50,000, and the credit is 15% of those expenses, up to $7,500. You can do this on a spreadsheet or directly on Schedule 12, as shown below. - Report the expenses on your tax return

On your personal income tax return, use Schedule 12 to report the eligible expenses. Only claim the expenses in the year the renovations are completed. - Keep documentation

Keep copies of all invoices, contracts, and receipts in case the CRA requests proof of your claim. - Combine with other programs carefully

You are allowed to apply for more than one tax rebate in the same year. For example, You may also qualify for GST/QST new housing rebates if the renovation involves substantial construction or a new unit. However, expenses claimed for the MHRTC cannot be claimed again for GST/QST rebates.

Note:

Final remarks

Canada’s multigenerational tax credit is a valuable tool for families who want to support independent, dignified living for seniors or adults with disabilities. By creating a self-contained, private unit within your home, you can claim a significant tax credit while also improving the quality of life for your loved ones.

It’s important to carefully plan your renovations, ensure that you stick to zoning laws, keep thorough documentation, and track all eligible expenses to ensure you receive the maximum benefit. You can combine the MHRTC with other programs, like GST/QST new housing rebates, but you cannot claim the same expenses twice.

Because the rules around eligibility, expenses, and documentation can be complex, it is best to consult a tax professional or accountant experienced with the MHRTC. This can help you avoid mistakes and maximize your total savings. If you do not know that your accountant has experience working with these programs, then ask your realtor for an introduction to one that does.

Ultimately, this credit is more than just a tax benefit. It is also an opportunity to create a safe, private, and functional living space that supports your family for years to come.

Need an housing expert?

With over 17,000 realtors in Québec, finding one who truly understands your project can be overwhelming. That’s why Immovision created a smart matching tool that analyzes training, experience, past transactions, and performance to find the best realtor for your specific project.

👉 Get 3 personalized realtor matches instantly — try it free today!