Planning to buy a home in Quebec? Use our Mortgage Comparison Calculator to see your full mortgage picture, including Quebec’s Quebec specific closing costs such as welcome tax and QST on CMHC default insurance and more. Compare down payments, amortization terms, interest rates, property taxes and property types to understand your exact monthly payments and the total cost of getting a mortgage in Quebec.

Mortgage Comparison Calculator

Property & Scenario Details

Cash Needed to Close

$0Monthly Expenses

$0Amortization Schedule & Visualization

About Quebec’s mortgage comparison calculator

This mortgage comparison calculator has been made for people who want to buy a house in Quebec. This means that we include in the calculation of several closing costs and carrying costs that are very specific to Quebec. By using this calculator, you are able to get a very precise estimate of what it will cost to buy a home or rental property in Quebec.

How to use the Quebec mortgage comparison calculator

To use the calculator you must enter:

- Home purchase price – This is the price that you aim to purchase your home for. This should be whatever the amount is that you got mortgage pre-approval for.

- Property location – In Quebec, there are several closing costs and carrying costs that are calculated based on the municipality or city where you buy. This includes your Land Transfer Tax and property tax (municipal and school).

- Down payment – In Quebec (and the rest of Canada), the down payment required to buy is based on the purchase price.For homes priced under $500,000, the minimum down payment is 5%. For the portion of the purchase price between $500,000 and $999,999, a 10% down payment is required. Homes priced at $1,000,000 or more require a minimum 20% down payment and are not eligible for mortgage default insurance. If you make less than 20% down payment, you will need to take out CMHC mortgage insurance. This will impact both your closing cost and your monthly carrying costs.

- Amortization – This is how long you have to pay off your mortgage. A shorter amortization will have larger monthly payments but, it will also mean that you pay less interest over the life of your mortgage.

- Mortgage rate – This is where you enter in the mortgage rate that your lender or mortgage broker quotes for you. There is the option to enter in up to four different rates at once.

- Payment frequency – This is how often you make mortgage payments. If you make payments more often (bi-weekly or weekly instead of monthly), you will reduce your principal balance sooner. This is because interest is calculated on the outstanding balance, and shorter frequency lowers the total interest you pay over time.

What results can you get from the Quebec Mortgage Comparison Calculator?

You will get the following results from this calculator:

- Total monthly mortgage payments – This is the amount that your lender will charge you each month. It includes both interest plus principal.

- Cash to close – This is the amount of money that you will need in your bank account to buy your home. It includes both your down payment and the extra closing costs.

- Carrying costs – These are the total monthly costs that you will need to pay on housing. It includes home insurance, property tax, utilities, and telecom and other debt payments.

- Lifetime mortgage cost – You can see the total lifetime cost of your mortgage split into interest vs principal payments. The interest is what you will pay to the bank and the principal is the equity that you build up in your home.

If you use this calculator, you’ll get a precise estimate of what different mortgages cost and how the terms you choose affect your monthly payments and total cost over time. This information will allow you to make smarter financial decisions.

How to compare mortgages?

When it comes to comparing mortgages, lenders and borrowers normally focus their negotiation on the interest rate that will offer. However, there are actually several factors that influence the overall cost of the mortgage. In this section, we will show you how the pros compare mortgages based on:

- Mortgage rate comparison

- Down payment comparison

- Amortization period comparison

- Payment frequency comparison

Mortgage rate comparison

A small change to any of your mortgage terms can have a massive impact on the total cost of your mortgage. For example, if you change the mortgage rate by just 1% (from 5% to 4%) on a 25 year mortgage with a 5% down payment, you can save $82,400 in total payments over the life of the mortgage.

| Mortgage | Down payment | Interest rate | Amortization period | Annual payment | Total paid |

|---|---|---|---|---|---|

| Mortgage 1 | 5% | 5% | 25 | $34,478 | 34,478 x 25 = $361,950 |

| Mortgage 2 | 5% | 4% | 25 | $31,182 | 34,478 x 25 = $279,550 |

Down payment comparison

The size of your down payment also massively impacts your total monthly carrying costs. This is for two reasons (1) you need to take out CMHC insurance on your mortgage for down payments of less than 20% and (2) the more down payment you can make up front, the smaller amount of money you need to borrow. CMHC insurance premiums are charged in 5% down-payment tiers. The less you put down, the higher the premium: a 5% down payment costs more than 10%, and 10% costs more than 15%.

The table below shows a comparison of how different down payment amounts impact your monthly for a property with a purchase price of $500,000.

| Mortgage 1 | Mortgage 2 | Mortgage 3 | Mortgage 4 | |

| Down payment % | 5% | 10% | 15% | 20% |

| Down payment amount | $25,000 | $50,000 | $75,000 | $100,000 |

| Total monthly mortgage payments | 2,873.13 | 2,698.36 | 2,541.03 | 2,326.42 |

Amortization period comparison

Another big driver of the total cost of your mortgage is the amortization period or the length of time that you borrow the money for. The shorter the amortization period, the higher your monthly payments but, the lower the total cost of your mortgage. The table below compares the total cost of mortgages with a 10% down payment, 5% interest rate and spread across different amortization periods:

| Mortgage 1 | Mortgage 2 | Mortgage 3 | Mortgage 4 | |

| Down payment % | 10% | 10% | 10% | 10% |

| Interest rate | 5% | 5% | 5% | 5% |

| Amortization period | 25 years | 20 years | 15 years | 10 years |

| Monthly mortgage cost | 2,698.36 | 3,048.73 | 3,656.50 | 4,909.28 |

| Total mortgage cost | 809,506.90 | 731,695.58 | 658,170.07 | 589,114.07 |

Payment frequency comparison

A lender’s default is to send you an invoice for interest plus principal once per month however, this is not always in your best interest. A shorter payment frequency will reduce the total cost of your mortgage by reducing the amount of interest that you pay to the bank. For example, consider the following scenario on a property with a $500,000 purchase price, a 4.14% interest rate and amortization period of 25 years and different payment frequencies.

| Mortgage 1 | Mortgage 2 | Mortgage 3 | Mortgage 4 | |

| Down payment | 20% | 20% | 20% | 20% |

| Amortization period | 25 years | 25 years | 25 years | 25 years |

| Mortgage rate | 4.14% | 4.14% | 4.14% | 4.14% |

| Payment frequency | Monthly | Weekly | Bi-Weekly | Accelerated bi-weekly |

| Total cost of mortgage | 640,364.54 | 639,523.76 | 639,775.84 | 639,775.84 |

How to compare closing costs?

Whilst your mortgage terms do not directly impact your closing costs, these do add to the cost of buying a home in Quebec. Depending on your down payment size, you may also have larger or smaller closing costs. The closing costs that you need to consider are:

- Welcome tax – This is a land transfer duty that Quebec home buyers must pay when they purchase a home in Quebec. The amount you must pay depends on where in Quebec you buy.

- Quebec Sales Tax (QST) on CMHC insurance premium – If your down payment is less than 20% you must get CMHC default insurance. The cost of the premium varies depending on the purchase price and the size of your down payment. Your lender will normally add the cost of the insurance premium to your mortgage. However, you must pay the QST at closing. To work out what your insurance premium will be.

- Notary fees – Under the Civil Code of Quebec, it is a legal requirement to use a notary to close a real-estate transaciton. The buyer typically agrees to pay for the notary in the promise to purchase.

- Inspection fees – The OACIQ (the Quebec real-estate regulator) advises all buyer’s to pay for a home inspection. This helps buyers (A) fully understand the condition of the property and (B) avoid the financial risks of latent defects.

- Home appraisal and title insurance – Lenders will typically order an independent home appraisal to confirm that the property’s value matches or exceeds the purchase price before approving the mortgage. This protects the lender by ensuring the property is worth the loan amount and helps prevent financial loss if the buyer defaults. Normally the lender will pay for the home appraisal and, if they do charge you for it, we would suggest asking to have this waived. Often the lender will comply in order to get you as a client.

How to compare mortgage carrying costs

Mortgage carrying costs are the ongoing expenses required to own and maintain a property. These include mortgage payments, property taxes, utilities, insurance, and home maintenance costs and / or condo fees.

When you get your mortgage pre-approval, the lender looks at how much of your gross income goes toward housing costs. To do this, they calculate two ratios: your Gross Debt Service (GDS) and your Total Debt Service (TDS). The lender uses these ratios to confirm that you have enough income to comfortably make your mortgage payments and, based on this, will offer you a pre-approved mortgage amount. This can be up to 42% of your monthly income.

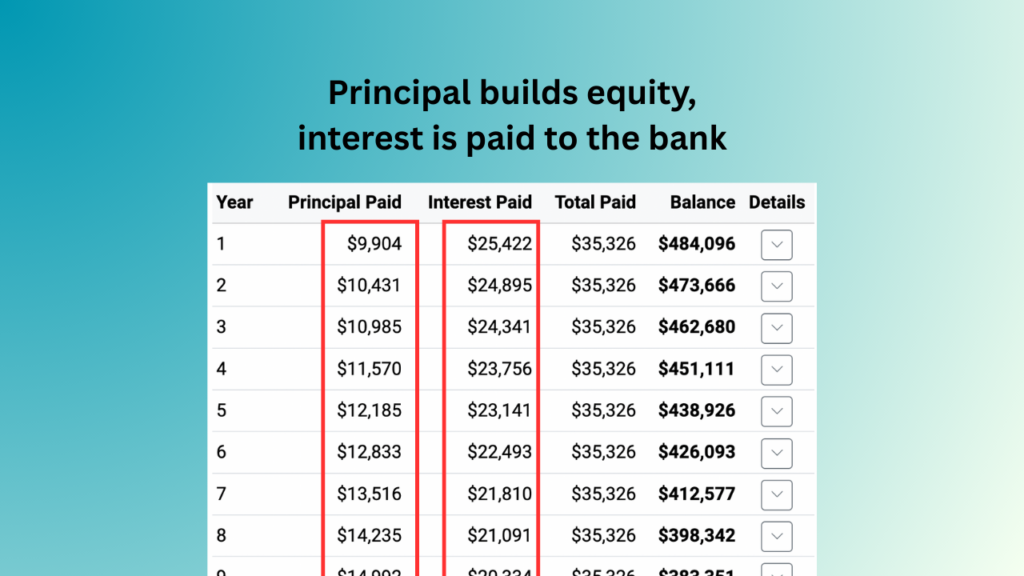

Understand your amortization schedule

The amortization schedule is a detailed plan showing how your mortgage payments are applied over time. It breaks down each payment into principal and interest and shows your remaining balance after every period. The interest you pay to the bank is not recoverable, while the principal you pay reduces your loan balance and builds equity in your home.

The goal is always to reduce the amount of interest you pay (if you can). As we have already seen, you can do this by playing to the terms of your mortgage however, most lenders will allow you to make principal only payments on top of your regular mortgage payments. The lender will normally cap this to a certain percentage of the total mortgage each year. If you pre-pay too much, this can incur pre-payment penalties. Some lenders also offer different types of mortgages that allow you to pay off the entire mortgage in one shot, under certain conditions.