Did you know that you can get up to $15,000 cash when buying a home in Montreal?

This cash is paid out by the City of Montreal and is available through a program called the Home Purchase Assistance Program.

The program is open to both first-time and experienced buyers, depending on the type of property and your family situation. The money is paid either as a refund for part or all of your “welcome tax” or is given to you as a cash payment of up to $15,000 directly into your pocket.

In this article, we show you:

- How to determine how much money you can get

- How to apply for the financial assistance (step by step)

How Much You Can Get from the Montreal Home Purchase Assistance Program

Before you start filling out forms, it helps to know what kind of refund or cash assistance you might qualify for. The amount of financial assistance you can receive depends on three main factors:

- Whether you’re buying a new or existing home.

- Whether you’re a first-time or experienced buyer.

- Whether you have children and their age.

Here’s a breakdown based on the City of Montreal’s 2025 program:

| Buyer Type | Property Type | Household Situation | Amount of Assistance | Form of Payment |

| First-time buyer | New home | No children | $5,000 | Cash grant |

| First-time buyer | New home | With at least one child under 18 | Up to $10,000 (outside downtown) or $15,000 (downtown) | Cash grant |

| First-time buyer | Existing home | With at least one child under 18 | Refund of your welcome tax (usually $5,000–$7,000) | Tax refund |

| Experienced buyer | New or existing home | With at least one child under 13 | Up to $10,000–$15,000, depending on location | Cash or tax refund |

| Any buyer | New home with environmental certification (LEED, Novoclimat) | — | +$2,500 to +$5,000 bonus | Added to grant |

Example scenarios

If you’re a first-time buyer purchasing a condo downtown with one child under 18, you could receive up to $15,000 in cash assistance from the City of Montreal.

Or, if you’re an experienced buyer with one child under 13 buying a duplex in Rosemont, you could get around $7,000 back as a welcome tax refund.

How to Apply for the Montreal Home Purchase Assistance Program (Step-by-Step)

Now that you have an idea of how much you could receive, let’s look at how to actually claim the money. Here are the five steps to follow to complete your application.

- Determine your eligibility

- Download & fill out the forms

- Gather key documents

- Get your solemn declaration notarized

- Finalize your application

We conclude this section with some practical notes and tips, such as where to get help (for free) if you are stuck with any of the steps.

Step 1: Determine Your Eligibility

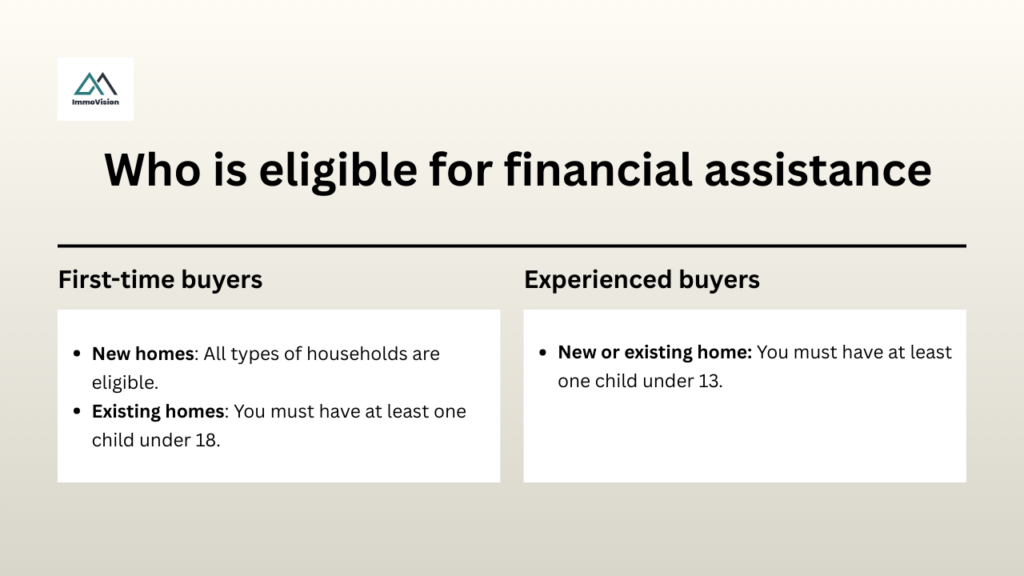

Before filling out forms, check whether you qualify under the city’s Home Purchase Assistance Program. The Home Purchase Assistance Program in Montreal is available for First Time Buyers and Experienced Buyers. The eligibility criteria are set out below.

First time buyers refers to anyone that has not owned a home in Quebec in the last 5 years. In this case, all types of households i.e. couples, families, singles etc. are eligible for the Home Purchase Assistance Program when they buy a newly constructed home. For existing homes, the first-time buyers are eligible for a welcome tax rebate but they must have at least one child under the age of 18. Meanwhile, for experienced buyers, the Welcome Tax is only exempt for new or existing homes where you have one child below the age of 13.

Once you’ve confirmed you’re eligible, it’s time to prepare your documents.

Note

Step 2: Download & Fill Out the Forms

If you qualify, the next step is to gather and complete the required document(s) under the Home Purchase Assistance Program.

Home Purchase Assistance Program.

You can then complete the relevant sections. If you need any help with this, ask your realtor for support.

Step 3: Gather Key Documents

You’ll need to assemble certain supporting materials:

- The deed of sale for your home.

- Birth certificate (or relevant proof) of a child under the required age (either under 18 or under 13, depending on your eligibility bracket).

- If applicable, any documents that show your household composition, address occupancy, etc.

Next, you’ll need to get one section of the form notarized. Don’t worry, it’s simple and inexpensive.

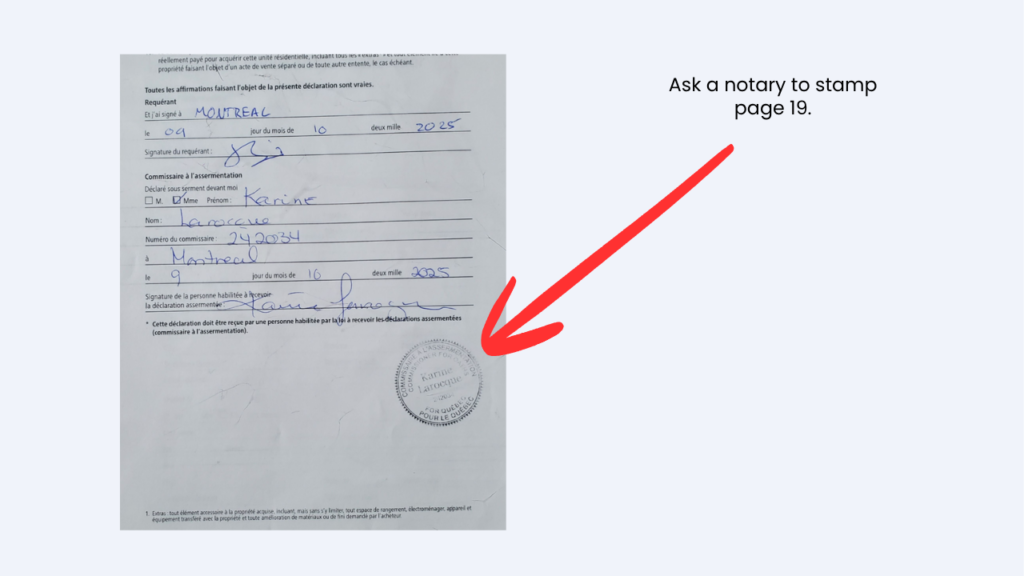

Step 4: Getting Your Solemn Declaration Notarized

Part 5 of the application is a Solemn Declaration that must be signed and notarized. A screenshot of what the notarized document looks like is included below.

To save cost and time, you can do all of this at the notary you choose to close the sale of your home. Alternatively, you can visit any notary after the transaction is complete and do it with them. The cost will be between $35 and $50 depending on the notary that you use.

Step 5: Finalizing Your Application

Once all the forms are signed and notarized, you must send these items to the city:

- The signed & notarized forms.

- A scanned copy of your deed of sale.

- Where required, a birth certificate of at least one child under the age condition (under 18 for first-time buyers; under 13 for experienced buyers) to prove eligibility.

- Any other required documentation as specified in the application guide.

You can then send the documents to the Home Purchase Assistance Program for review, using either:

- 📧 Email: Attach the documents to an e-mail and send them to:

- 👤 In person: Print them and deliver them in person at:

- any Accès Montréal office

- ✉️ Send by post: Or send them by postal mail to

- Service de l’habitation, 303 Rue Notre-Dame Est, 4th floor, Montréal QC H2Y 3Y8

Final Notes, Timelines and Insider Tips

- You must pay the transfer tax “welcome tax” first to the city, then apply for the refund or assistance.

- Be sure to submit your application within the allowed timeframe: generally within 6 months of the deed being registered, or according to deadlines specified by the program.

- The home must meet certain criteria (for example: single-family detached homes, semi-detached, row house, co-ownership, or small residential rental building with 2–5 units) and you must commit to making it your primary residence for a period (e.g., 3 years) to avoid having to repay the assistance.

- If you have absolutely any further questions, the program administrators are open to the public on Thursdays from 8:30 am to 4:30 pm at the following address: 155, Notre-Dame East Montreal (Quebec) H2Y 1B5. I have personally been there to complete this exact document, and they notarized my documents without charge.