When you buy a property in Quebec, the municipality charges the buyer a land transfer tax. People commonly refer to this as the “welcome tax.” The amount that you must pay depends on the property’s value and the municipality’s rates. This can add tens of thousands of dollars to your closing costs when you buy a home. However, in some cities (like Montréal) there are programs that can reimburse part or all of the tax for qualifying buyers.

In this step by step guide, we cover how to recover part or all of your welcome tax.

More specifically we will cover:

- What is Welcome Tax?

- How much Welcome Tax must you pay in Quebec?

- How to claim back your Welcome Tax (Step-By-Step)

- Find out if your municipality offers a welcome tax rebate

- Determine eligibility

- Final remarks

Buyers Note

For a comprehensive overview of the programs and how to make them work for you, check out the ImmoVision Real Estate Academy.

The welcome tax is a transfer duty that the municipality charges to the home buyer when a property changes ownership. Quebec law requires all municipalities to charge this tax on real estate transactions within their jurisdiction. The municipality charges the welcome tax on whichever amount is higher: the purchase price or the municipal evaluation.

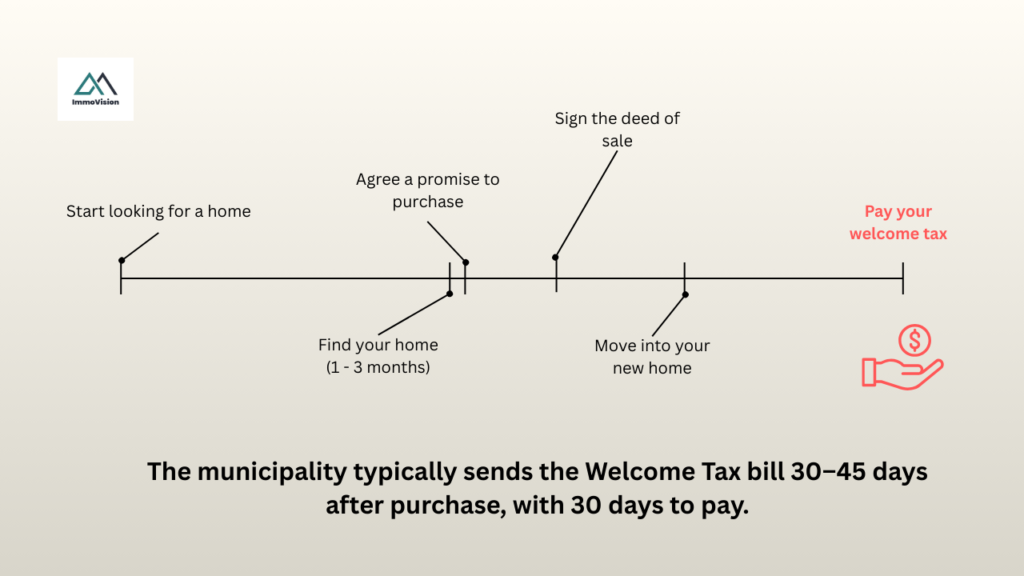

For instance, let’s say that I buy a house worth $500,000 on the Island of Montreal. In this case, the city would bill me $5,653.50 in Land Transfer Tax about one month after closing. The image below explains what happens and when.

The amount of welcome tax you must pay depends on several factors, including the purchase price of the property and the municipality in which it is located, as each city applies its own tax rates and brackets.

At ImmoVision, we’ve developed a Welcome Tax calculator to help you estimate how much you may owe based on the location of your property. Our calculator currently supports purchases in the following municipalities:

- Montréal

- Longueuil

- Brossard

- Laval

- Québec City

- Gatineau

Use the calculator below to get an estimate of your Welcome Tax based on your specific situation. In the

Welcome Tax Calculator

Buyers Note

In this section we break down the steps that you need to take to claim all or part of your welcome tax back. Note, that every municipality has a different process and some do NOT offer you a welcome tax rebate. In our example we will use Montreal’s Home Purchase Assistance Program, which is the City of Montreal’s welcome tax rebate program.

The steps are as follows:

- Find out if your municipality offers a welcome tax rebate

- Determine eligibility

- Check the timelines for time limit to submit an application

- Gather key documents

- Get the forms notarized (if necessary)

- Submit your documents

1. Find out if your municipality offers a welcome tax rebate

Before you start filling out forms, it helps to know if the municipality in which you are based offers a welcome tax rebate. Most municipalities in Quebec have very limited information on their websites. Therefore, the most reliable way to figure out if there is a welcome tax rebate is to call the municipality directly and ask them.

For instance, let’s suppose that you buy in a municipality like Brossard. There is no mention of a welcome tax rebate on their website and so it is very unlikely that one exists. However, you should still call to ask under what conditions the municipality can waive the Welcome Tax. For example, if you transfer a home between family members, the municipality may waive the tax. In addition, you can take the time on the call to discuss other rebates or assistance programs that the municipality offers.

In Montreal, you can use the Home Purchase Assistance Program. This allows you to claim up to $15,000 on your home purchase (under certain conditions). This program is available for all of the municipalities that form the urban agglomeration of Montreal, essentially anywhere “on the Island”, provided you meet the eligibility conditions.

Buyers Tip

If you are looking for a realtor in your area, we have a free broker matching service.

2. Determine eligibility

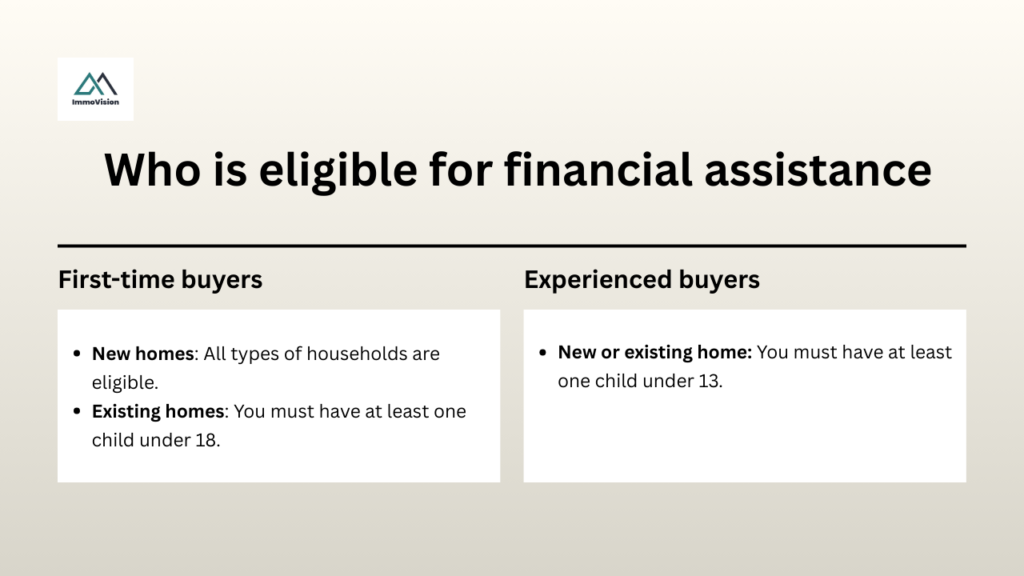

Eligibility varies according to the rules in your municipality. This is because each municipality will have its own program and rules. For instance, in Montreal the Home Purchase Assistance Program has the following eligibility criteria. These apply for first time and experience buyers.

First time buyers refers to anyone that has not owned a home in Quebec in the last 5 years. In this case, all types of households i.e. couples, families, singles etc. are eligible for the Home Purchase Assistance Program when they buy a newly constructed home.

For existing homes, the first-time buyers are eligible for a welcome tax rebate but they must have at least one child under the age of 18. Meanwhile, for experienced buyers, the Welcome Tax is only exempt for new or existing homes where you have one child below the age of 13.

Once you confirm your eligibility, the next step is to check the submission timeline guidelines.

Buyers Note

For more information read our article GST/QST New Housing Tax Rebate.

3. Check the timelines for time limit to submit an application

The Home Purchase Assistance Program has strict deadlines, and missing them can result in losing your eligibility. The deadlines depend on when you apply and which document you use to apply.

If you apply using an Offer to Purchase (preliminary contract)

- You can submit your application as early as 18 months before the expected date of signing the deed of sale.

- You must submit the application no later than 1 day before the deed of sale is signed.

- After the deed of sale is signed, you have 6 months to submit any required supporting documents.

If you apply using the Deed of Sale

- You must submit your application within 6 months of the transaction being recorded in the Land Register.

- Once your application is approved, you have 6 months to provide any required supporting documents.

4. Gather key documents

As with the other steps in this guide, you need to check what documents your municipality will need in order to validate that you purchased a home and that you are eligible for their welcome tax rebate.

If you are applying for the Montreal Home Purchase Assistance Program, you will need to gather and complete the following documents:

- Deed of Sale (this will be used to prove the date that you purchased your new home)

- Form – Home Purchase Assistance Program

- Birth certificate of your child – if applying as a family.

You may also optionally use the Promise to Purchase rather than the Deed of Sale, to get pre-approved for the Home Purchase Assistance Program provided that the Deed of Sale will be signed within 18 months of the Promise to Purchase. This is allowed since the Promise to Purchase is a legally binding agreement that proves intent to purchase.

The “Form – Home Purchase Assistance Program” is the most complex form in this process. It is split up into 5 sections, an addendum and a document checklist. It can be difficult to know which parts to fill in and where to find the information required to complete this form. Let’s quickly go through each section now:

Part 1: General Information

Most of this section is pretty self explanatory however, you will need to know two technical terms to complete this section properly. These are:

- Deed of Sale

- Offer to purchase (aka. Promise to Purchase)

The Deed of Sale is a document that you sign when you complete the transaction with the home seller. This document is signed in the presence of a notary. Once signed, the notary will update the Quebec Land Register with the information about your home purchase. As such, in this section, if you have completed the transaction, you will be submitting the application on the basis of a Deed of Sale. However, if you have not yet purchased your home, you will be submitting the application on the basis of an offer to purchase.

The offer to purchase (also called the Promise to Purchase) is a legally binding document that you complete and sign when you make an offer to buy a home. It includes (amongst other things) the price and terms of your agreement. If you are submitting this application on the basis of the Promise to Purchase, ask your realtor for the associated document.

All of the other parts of Part 1: General Information are self explanatory. However, if you have any questions, you can ask your realtor for support.

Part 2: Buyer of a new residential property

This section of the Montreal Home Purchase Assistance program relates only to buyers of a new residential property. These are newly constructed homes where you are buying the home directly from the builder of the home. If this is not you, you can skip to Part 3: Buyer of an existing residential property.

In this part, you will need to know:

- What is the type of property you are buying e.g. Single-Family Home (detached, semi-detached, rowhouse etc.)

- The area of your residential unit. You can find this information in the Certificate of Location.

- Have you purchased parking spaces?

- Is your property located downtown?

- How many closed bedrooms are in your unit.

You will also need to have the person who built your home complete the “Contractor Declaration” section. This is a declaration from the builder confirming that the property qualifies as new construction. The form must be completed and signed by the contractor or developer.

Most builders are familiar with this requirement, and you can usually request it after your offer (promise) to purchase has been accepted. If you want to be certain it will be provided, you can also make it a condition of your Promise to Purchase. If you encounter any difficulties, your real estate broker can help facilitate this.

Part 3: Buyer of an existing residential property

This section is for the buyer of a pre-existing residential property i.e. a property that has not been newly constructed. If this is not you, you can skip this section.

In this part, you will need to know:

- The type of property you purchased

- If the type of property is a divided condo or not:

- Does the co-ownership stem from the conversion of a rental property?

- In other words, was the building previously used as rental housing and later converted into individually owned condo units?

- Does the co-ownership stem from the conversion of a building already held in undivided co-ownership?

- In other words, was the property originally owned collectively by multiple owners and later divided into separate condo units?

- Was this condo conversion officially approved by the RBQ before May 1, 2018? You need to ask your realtor this question.

- This is a key eligibility question for certain assistance programs. Your real estate broker should be able to help you verify this information by reviewing the building’s documentation.

- How many units are in the dwelling

- What is the area of your dwelling unit? You can find this information in your Certificate of Location.

- How many bedrooms are there in your dwelling?

- Do you have a parking space? And how many?

Once you have answered the questions, each of the owners must certify that the answers provided in the document are true.

Buyers Note

The OACIQ (Québec’s real estate broker regulator) requires that real estate brokers act diligently and in the public’s interest. This includes a duty to take reasonable steps to verify the accuracy of information provided by the seller when that information is relevant to the transaction. In practice, this means that when a buyer asks a question, the broker cannot simply repeat what the seller says without verification if there are reasons to doubt the information or if verification is reasonably possible.

If a broker fails to verify important information they should have verified, or communicates misleading or inaccurate information, they may be in breach of their professional obligations and could be subject to disciplinary penalties under OACIQ rules.

Part 4: Information regarding all applicants

This section of the Home Purchase Assistance Program asks for background information about the applicants such as age, education levels and so on. This section is not mandatory to complete however, it is only for the benefit of the City of Montreal so that they can update their housing programs to better serve the people who live in the city.

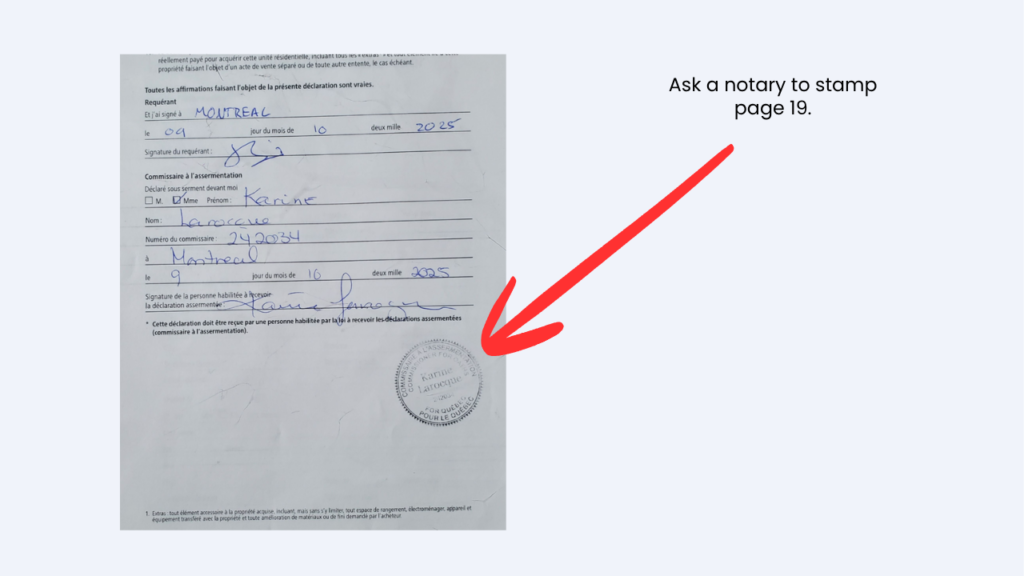

Part 5: The Solem Declaration

This section requires all applicants to formally declare that the information provided in the application is accurate and that they meet the program’s eligibility requirements. All applicants must sign and date this declaration.

This declaration must be made before a person authorized by law to receive solemn declarations (a Commissioner of Oaths). In practice, this means you must sign the form in the presence of an authorized individual such as a Québec notary, lawyer, or other Commissioner of Oaths who will verify your identity and witness your signature. A screenshot of what this looks like is shown below.

Buyers Note

4. Get the form notarized

Once all the forms are signed and notarized, you must send these items to the city:

- A scanned copy of your Deed of Sale or Promise to Purchase

- The completed, signed and notarized Form – Home Purchase Assistance Program

- Where required, a birth certificate of at least one child under the age condition (under 18 for first-time buyers; under 13 for experienced buyers) to prove eligibility.

- Any other required documentation as specified in the application guide.

These documents can be:

- Scanned and emailed to [email protected].

- Printed out and delivered In person at an Accès Montréal office at 303 Rue Notre-Dame Est, 4th floor, Montréal QC H2Y 3Y8

- Or printed and sent by postal mail: Service de l’habitation, 303 Rue Notre-Dame Est, 4th floor, Montréal QC H2Y 3Y8

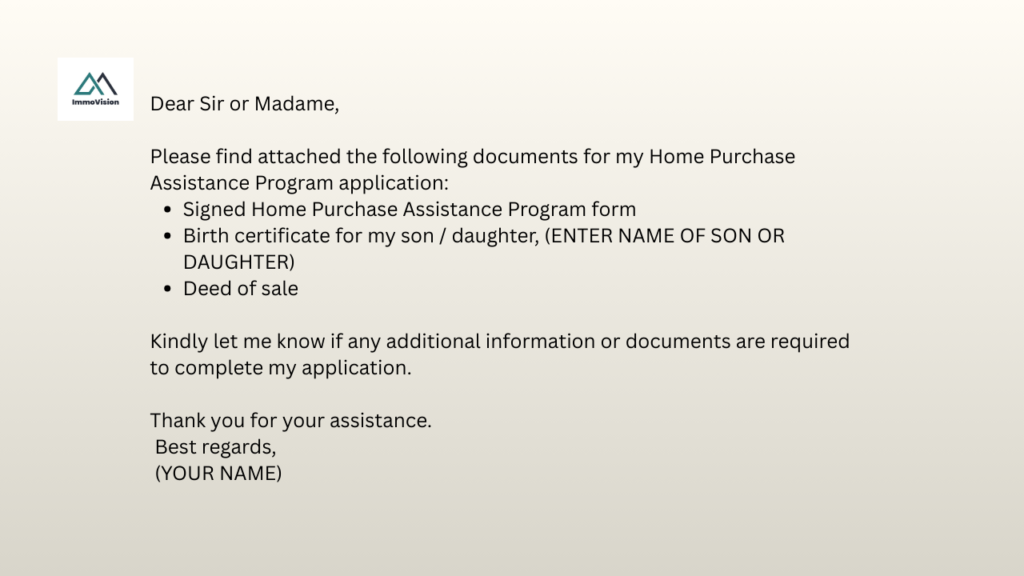

If you choose to email the forms, you can write something simple as shown below:

Buyers Note

When buying a home in Québec, check with your municipality for any Welcome Tax exemptions or rebates. In Montréal, the Home Purchase Assistance Program allows eligible buyers to claim up to $15,000, and there are many other federal, provincial, and municipal tax credits and financial assistance programs for homebuyers and renovations. These programs can often be combined, so if you’re unsure whether you’re maximizing your benefits, it’s wise to consult an experienced accountant.

Finally, work with a local realtor who has a network of professionals — notaries, builders, and mortgage specialists — to ensure your purchase goes smoothly and you take full advantage of available programs. Tools like our Welcome Tax calculator and resources from the Real Estate Academy can also help you plan and save.