Now more than ever, first time home buyers face huge financial challenges when it comes to buying a home. The situation is so difficult that the federal government, provincial government and local municipalities all offer incentives to help first time buyers get onto the property ladder.

In this article we cover the complete list of first time home buyer incentives. More specifically we cover:

- What are first time buyer incentives

- Federal first time buyer incentives

- Quebec provincial incentives

- Municipal incentives for first time buyers

- Final remarks

What are first time buyer incentives

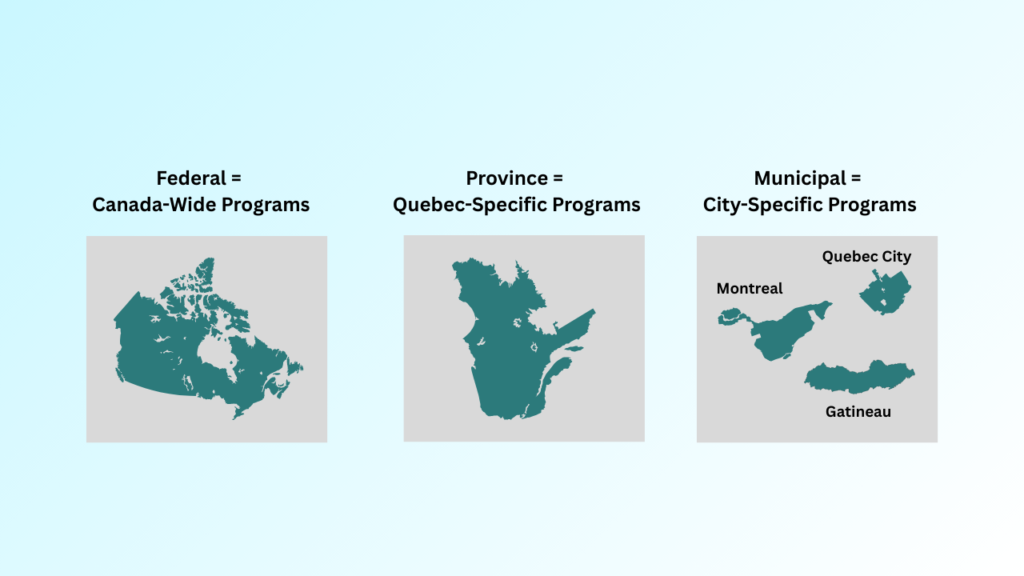

First-time buyer incentives are financial programs, tax credits, and savings tools designed to reduce the upfront and long-term costs of buying your first home. The federal government, the Quebec government, and local municipalities each offer incentives, and the type of support available depends on where you live.

Federal first time buyer incentives

Canada’s federal government offers the following first time buyer incentives:

When fully maximized, these can save first time home buyers tens of thousands of dollars. Let’s take a quick look at what each of these are now.

First time home buyers tax credit (HBTC)

The Canadian government offers first time home buyers a non-refundable tax credit of up to $1,500 through the First time home buyers tax credit (HBTC). This program, eligible buyers can reduce the amount of federal income tax they owe in the year they purchase their first home.

The way it works is that the government lets first time buyers claim a $10,000 Home Buyers’ Amount on your tax return. Think of it like a $10,000 “tax coupon” however, instead of giving you cash, it reduces the federal tax you owe on that $10,000 by 15%, which equals $1,500.

To apply for this program, you should first check your eligibility and then, if you qualify, simply enter the $10,000 Home Buyers’ Amount on line 31270 of your federal income tax return for the year you purchased your first home.

Registered investment accounts

The Canadian government offers two registered investment accounts designed specifically to help first-time buyers save for a home: First Home Savings Account (FHSA) and the RRSP Home Buyers’ Plan (HBP)

The First Home Savings Account (FHSA) lets first-time buyers deduct their contributions from taxable income and reach a down payment faster. For example, suppose you make $100,000 per year, you would normally pay approximately $39,000 in tax, (assuming a marginal tax rate of 39%). However, if you pay $8000 into your FHSA, this reduces your taxable income to $92,000, which lowers your tax bill to $35,880 for the year. This is a saving of $3,120.

The RRSP Home Buyers’ Plan (HBP) allows you to withdraw money tax-free from their Registered Retirement Savings Plan (RRSP). However, unlike the FHSA, you must pay the money back into your RRSP within 15 years, starting 2 years after the initial withdrawal. As such, the primary benefit of the HBP is that it gives first-time buyers a way to access their own savings for a down payment without triggering an immediate tax bill. Think of it like a loan to yourself.

– First Home Savings Account (FHSA) – Everything You Need to Know (2026)

– RRSP Home Buyers’ Plan (HBP): How it works & is it worth it (2026)

Quebec provincial incentives

Next, first time buyers in Quebec have access to two main provincial incentives. These are:

First-time buyers can combine both programs with federal incentives to save even more money on their home purchase.

Quebec first time buyers tax credit

The Quebec First Time Buyers Tax Credit functions in much the same way as the Federal First Time HBTC. Essentially this allows you to get up to $1,400 cash back when you file your end of year taxes.

The way it works is that Quebec lets you claim a $7,500 Home Buyers’ Amount on your provincial tax return. At the lowest provincial tax rate of 18%, this gives a $1,400 credit, lowering your provincial taxes owed the year you buy your first home.

To be eligible, you must be a resident in Quebec on December 31st of the year you purchase your first home, and the property is a qualifying property located in Quebec. You may also be eligible if you bought a qualifying home intending to make it the principal residence of a relative who is a disabled person. Once you have confirmed eligibility, to claim the credit you must complete and include form TP-752.HA-V with your tax return.

QST/GST new housing rebate

When you buy a newly built or substantially renovated home in Quebec, you must pay both the Quebec Sales Tax (QST) and the federal Goods and Services Tax (GST). The QST/GST new housing rebate allows first time buyers in Quebec to recover part of the QST and GST.

For example, let’s say that you buy a new home worth $750,000 in Quebec. You will need to pay $37,500 in GST and $74,812.50 in QST on top of the home purchase price. The QST/GST new housing rebate program allows first time buyers to claim back up to up to 36% of the GST paid (to a maximum of $6,300) and up to 50% of the QST paid (to a maximum of $9,975). You can find this tax information in your promise to purchase under Clause 4, “Price and deposit (plus taxes, if applicable).

Municipal incentives for first time buyers

Some Quebec municipalities offer incentives for first time buyers. The two most well known programs are:

Montreal Home Purchase Assistance Program

Montreal’s Home Purchase Assistance Program is a financial assistance program that provides eligible residents with a subsidy for the purchase of a condo, house or residential building in Montreal. The program supports individuals and families, particularly with children, in buying a property and motivates them to remain on the island. Depending on your situation, you can receive a lump sum for the purchase of a newly built property or benefit from a refund of your real estate transfer tax (welcome tax) when you buy an existing property.

Quebec City Family Access Program

The Quebec City Family Access Program offers financial assistance in the form of an interest-free loan. Eligible couples (with or without children) and single-parent families with a maximum gross household income of $150,000 may qualify for a loan of up to 5.5% of the property’s purchase price. The home’s purchase price cannot exceed $370,000, and applicants must not have owned a property within the five years preceding the purchase. The program also rewards buyers of Novoclimat-certified properties with a further 3.5% mortgage rebate.

Final remarks

It is very hard for first time home buyers to save for their initial down payment. Once this has been saved for, they then learn that they must budget approximately 2 – 4% more for closing costs including things like land transfer tax, notary fees and so on.

The first time home buyer incentives in Quebec can really help reduce the total cost of buying home. Although you will need to put down a large amount of money initially, first-time home buyers in Quebec can claim back up to 3% of the total purchase price. This is roughly the cost of a new car, a few extravagant holidays with your family, or a boost to your retirement savings. As such, first-time buyers should take full advantage of these incentives.

If you are looking for help with anything in the home buying journey, feel free to reach out. At Immovision we have helped hundreds of people buy houses by connecting them with high performing and verified realtors in Quebec. Simply tell us a bit about your project and we will reach out to discuss your project with you and see how we can help.

👉 Start your home buying journey now.