Promise to Purchase Definition

The promise to purchase is the first official step toward buying a home in Quebec.

Here’s how it works.

First, you find a property you love and that is within your budget. Next, you talk it over with your real estate broker, who helps you weigh the pros and cons.

Once you’re ready to move forward, your broker prepares and submits a promise to purchase to the seller. This document outlines your offer price and the conditions required to complete the transaction.

This might seem like a formality, but it is actually one of the most important steps in the entire transaction. In this article we cover:

- What is a promise to purchase in Quebec

- What goes into a promise to purchase?

- Inside the Promise to Purchase: The 16 key sections explained

- Frequently asked questions

- Final remarks

What is a promise to purchase in Quebec?

In Quebec, a promise to purchase (sometimes called an offer to purchase) is the formal way that a home buyer makes an offer to a home seller. In short, it is a contract that sets out the price, conditions and timeline for buying a property.

Since the promise to purchase is a contract, this means that once the seller receives the promise to purchase it is legally binding. As such, a buyer cannot back out of the contract once the seller receives the offer, unless the seller fails to fulfill a condition in the promise to purchase.

What goes into a promise to purchase?

In Quebec, the promise to purchase is a template document provided by the OACIQ. This is the regulatory authority that oversees real estate brokers and agencies. There are different different templates depending on the type of property. For example, the OACIQ offers one template for divided versus undivided co-ownerships and another for residential buildings with fewer than five units that do not belong to a co-ownership.

Below are some examples of promise to purchase templates with links to the official downloadable versions:

- Residential property with fewer than five units (not a condo) Download PDF

- Condo (divided co-ownership) Download PDF

- Undivided co-ownership (shared ownership) Download PDF

- Immovable / general property Download PDF

- Property sold by the Public Curator Download PDF

Whilst there are different templates, each document follows the same legal structure.

Inside the Promise to Purchase: The 16 key sections explained

Below you’ll find the 16 standard sections of a promise to purchase, along with a brief explanation of what each section covers. Once you understand what these mean, you will be able to use the promise to purchase as a negotiation tool.

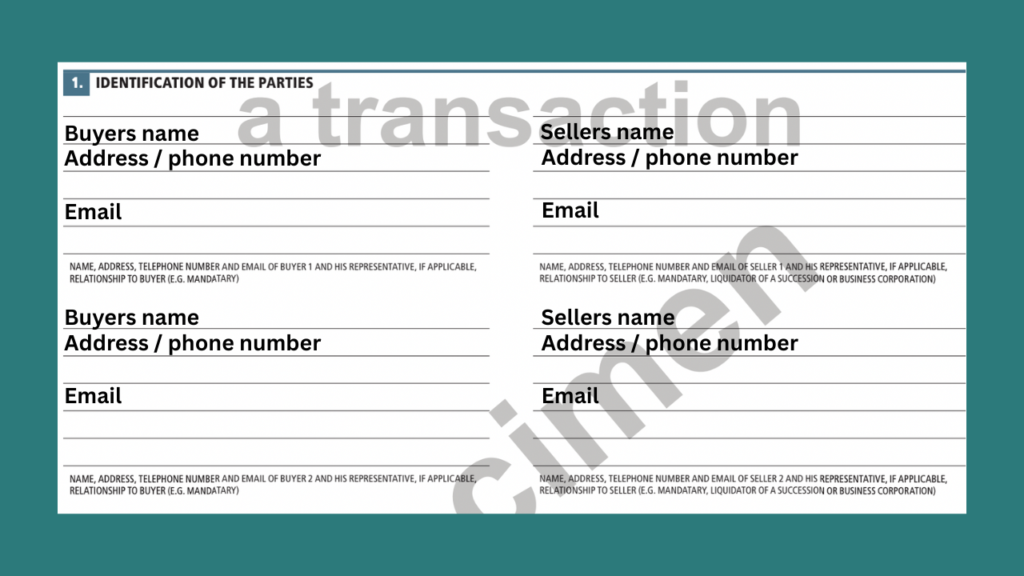

1. Identification of the parties

This section lists the buyer’s and seller’s legal names and contact information. This confirms who the contract binds. There may be multiple buyers and sellers. If this is the case you need to list out all parties in the transaction.

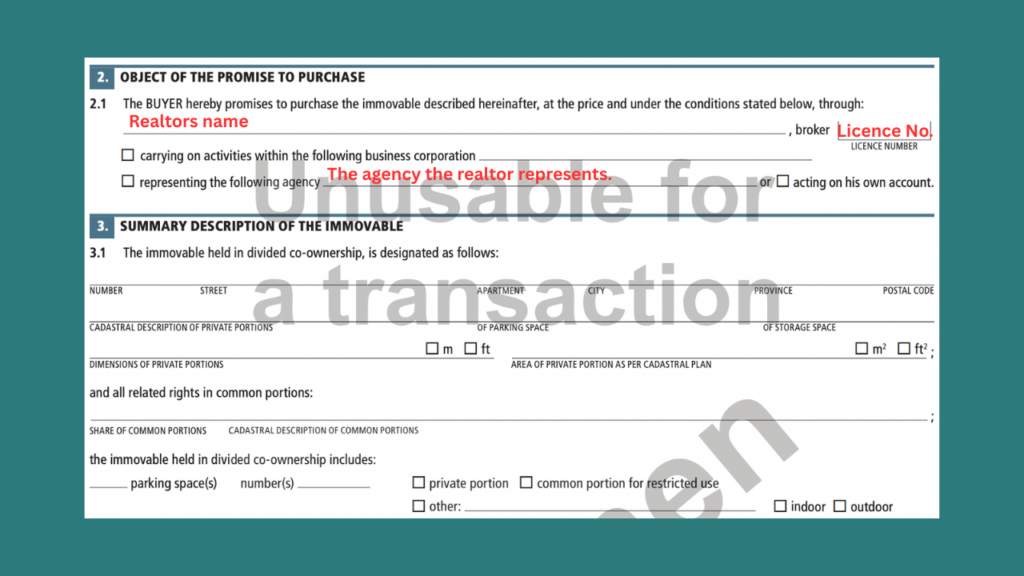

2. Object of the promise to purchase

The second part of the promise to purchase is where you write who your real-estate agent is. Their name, licence number, the name of their corporation, agency or if they are working alone.

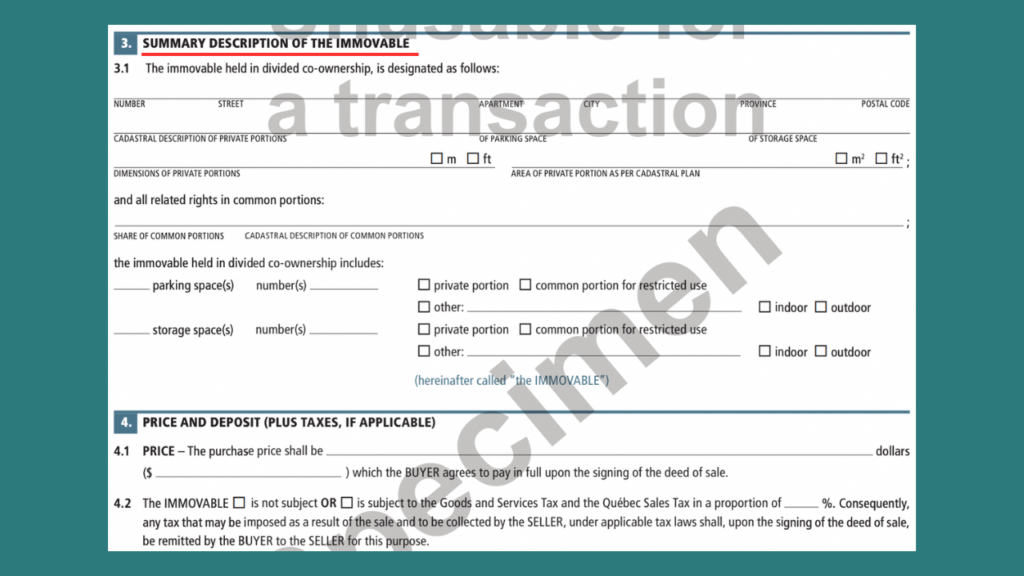

3. Summary of the immovable

The immovable is the type of property (e.g. condo, townhouse, duplex) and its key characteristics such as parking spaces, storage or private land area. All of the land in Quebec is divided into lots and each lot has its own lot number, also known as a cadastral number. To ensure that you are offering to buy the correct property, you should check the cadastral number and the cadastral description in the Quebec Land Register.

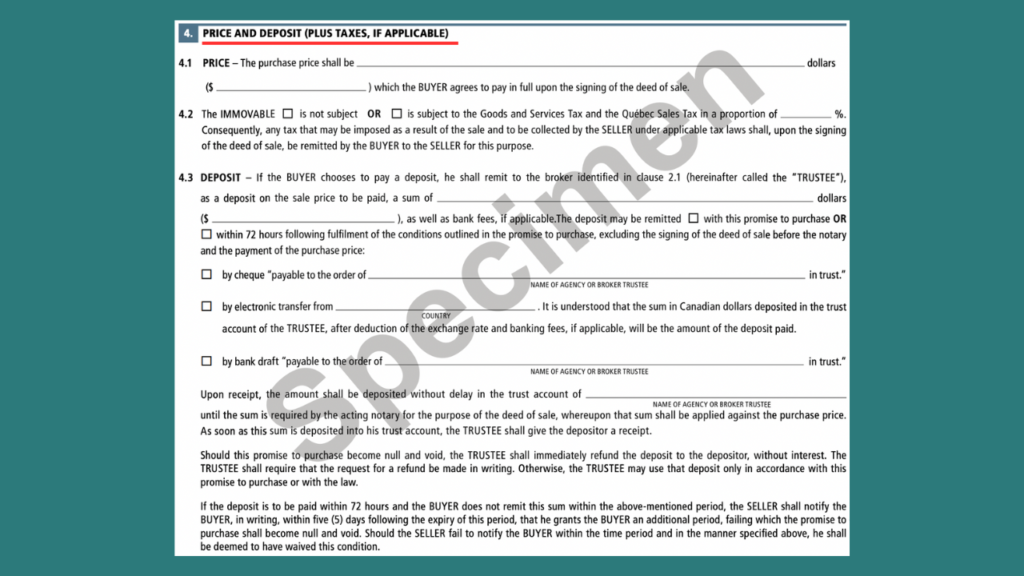

4. Price and deposit (plus taxes if applicable)

Clause 4 states the price that you want to offer to buy the property, the deposit amount and whether taxes (GST/QST) apply. Deposits are not mandatory however they can be a tool to help make your offer stand out if there are multiple buyers offering to buy the same home. If the buyer decides to offer a deposit, then statement is that the buyer provides a deposit in good faith, and the real estate agency or broker holds it in trust.

Regarding taxes, it is worth noting that the federal and provincial governments in Canada charge taxes on new or substantially renovated properties (GST and QST respectively). You will input any taxes on the property at this point.

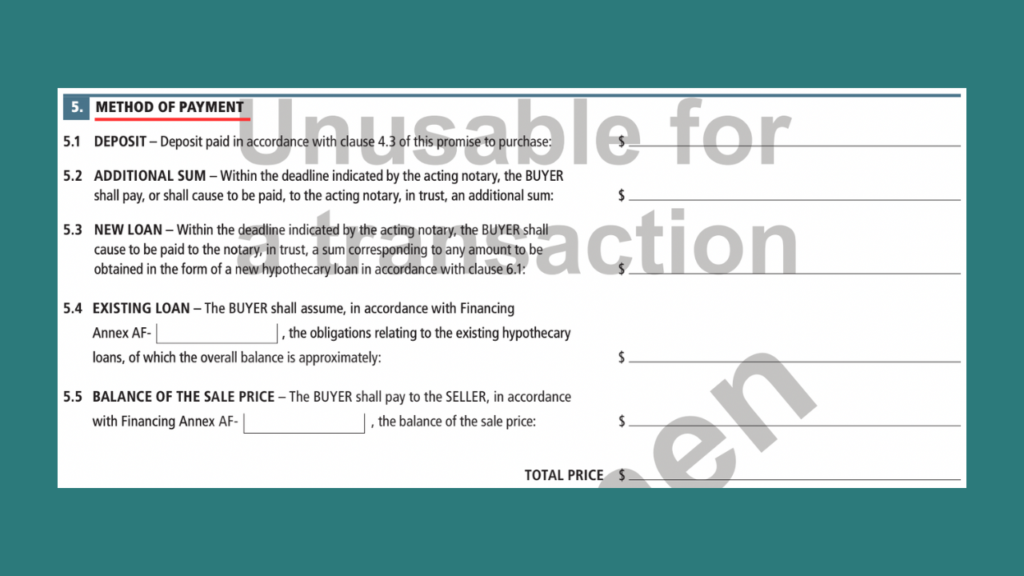

5. Method of payment

Section 5 of the promise to purchase explains how the buyer will pay for the property. For example, the deposit amount, the size of the downpayment, through a mortgage and/or using funds from the sale of another property.

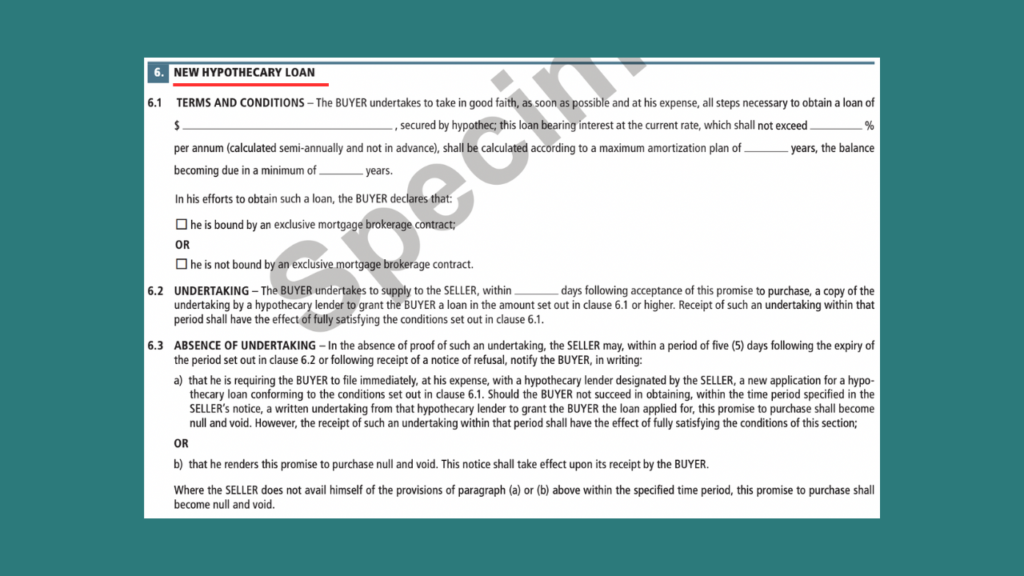

6. New hypothecary loan

In Section 6, you outline the terms of the mortgage you are applying for, including the amount you intend to borrow, the interest rate, and the mortgage length and term. You can also indicate how much flexibility you are willing to allow for these terms. For example, even if a lender pre-approves you at 3.5%, you can state a slightly higher rate, such as 4%. This allows you to satisfy your financing condition if rates rise before you finalize your mortgage.

The buyer also gets one “undertaking” that they must complete within a agreed number of days. After the seller accepts your offer, you have this period to obtain a written loan commitment from a mortgage lender that meets or exceeds the loan amount stated in the contract. Once the seller receives this commitment, the financing condition is satisfied.

However, if you fail to provide the loan commitment within the deadline, the seller may notify you in writing and declare the promise to purchase null and void, effectively canceling the agreement. In this case the buyer may lose their deposit, and the seller may seek compensation if they suffered a loss.

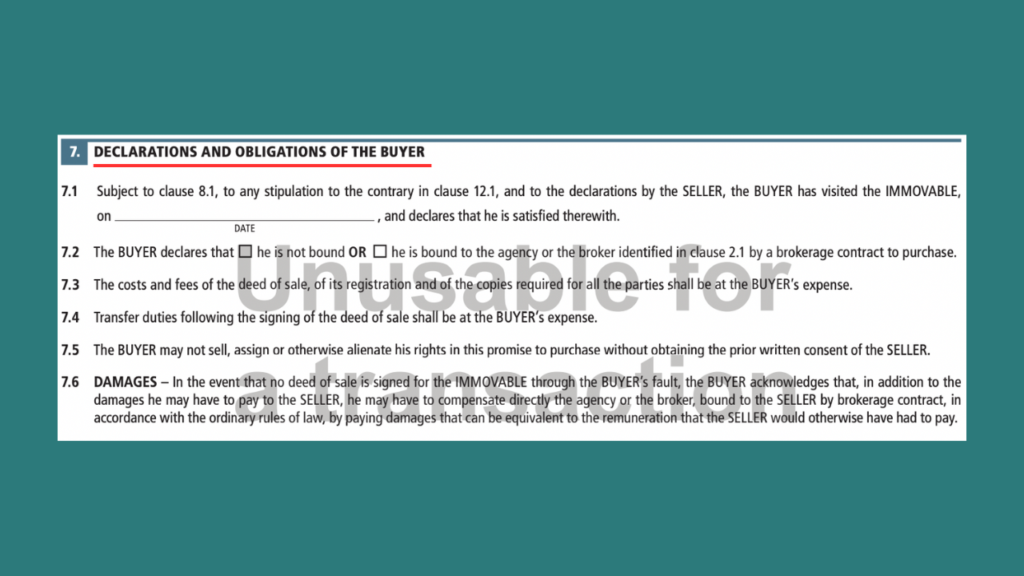

7. Declaration and obligation of the buyer

In Section 7, the buyer makes a series of declarations that they affirm are true and for which they take full responsibility. These include confirming that they visited the property on a specified date, which ensures that the seller will transfer the property in the same condition it was in on that day. The buyer also declares that, to the best of their knowledge, no law (such as bankruptcy restrictions), contract, or court decision prevents them from completing the transaction.

Next, the buyer agrees to cover the notary’s fees for organizing the closing, preparing the deed of sale, and registering the transaction with the appropriate land registry. They further commit to paying any transfer duties, such as the welcome or land transfer tax, and to attend the signing of the deed of sale on time.

Additionally, the buyer irrevocably promises not to sell, transfer, or assign any rights or obligations under the promise to purchase and acknowledges that only they are responsible for fulfilling the agreement.

Finally, the buyer recognizes that failing to fulfill any obligation under this promise may entitle the seller to claim damages. This may include retaining the deposit and seeking additional compensation to cover any losses or expenses resulting from the buyer’s non-compliance.

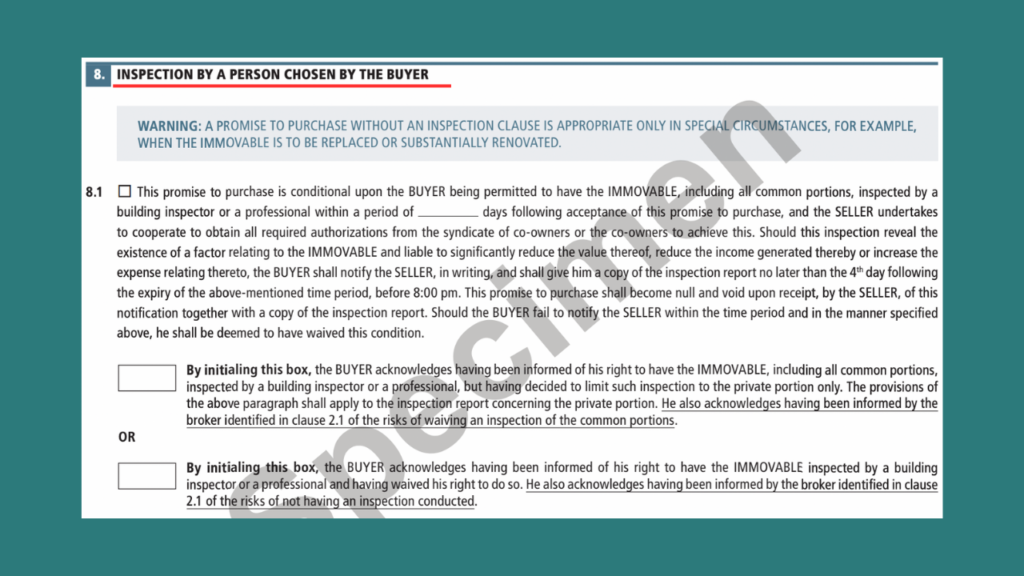

8. Inspection by a person chosen by the buyer

This section gives the buyer the right to have the property inspected by a qualified professional within a specified timeframe. It is essential to hire an experienced inspector to evaluate the property thoroughly because, once you purchase the home, the responsibility for repairing any defects generally falls on you.

A professional inspector can also advise you on the appropriate tests to conduct for specific risks such as pyrite issues or other structural concerns. While a seller may be responsible for defects that the inspector should have detected but missed in their report, it is still the buyer’s responsibility to order the right inspections.

You can make your offer conditional on satisfactory inspection results. Buyers and their brokers often refer to this as the “pre-inspection clause”. Many inexperienced buyers think of the pre-inspection clause as a “global way out” of the deal. However, this is not actually the case. In fact, you can only utilize the inspection clause to withdraw your offer if the inspection uncovers a significant problem; minor issues or cosmetic defects do not justify cancelling the purchase.

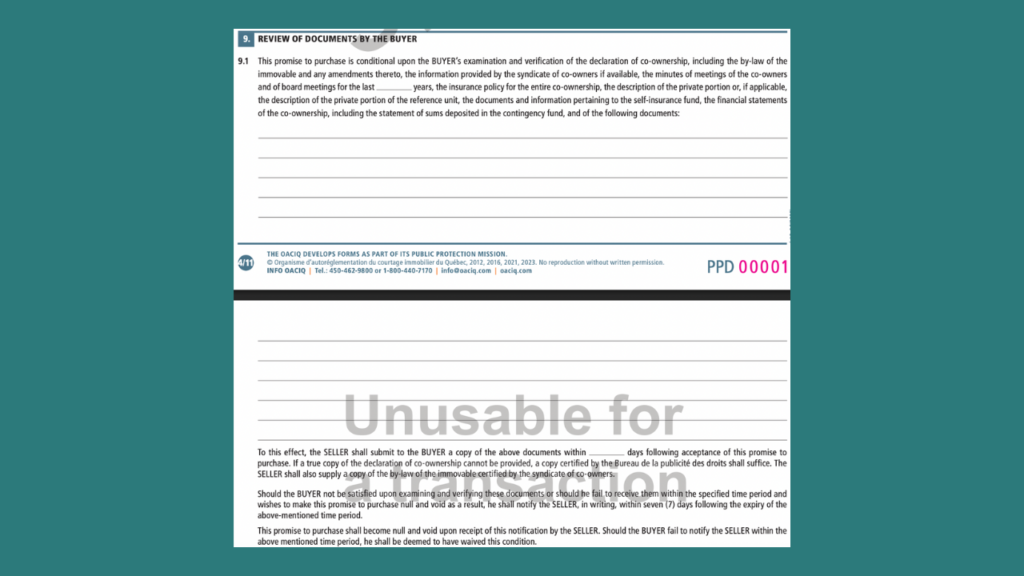

9. Review of the documents by the buyer

In this section, we outline which of the documents we want to receive from the seller in order to review before the final decision to buy. The buyer and their broker are allowed to review these documents to their “complete satisfaction”. This is super interesting, because it gives you a window into the seller’s disclosures, the condition of the property, and any potential issues that could affect your decision to proceed.

Buyers should request items such as heating bills, records of any construction work (to confirm it was done legally), the certificate of location and verification of any warranties or guarantees provided by the seller. If you are buying into a co-ownership (i.e., a condo), you should also review the meeting minutes, the status of the reserve (condo) fund, documentation required under Bill 141, and the maintenance log.

We also outline the timeline for this process: the seller will have a set number of days to provide the requested documents, and the buyer will have seven days from receipt to review them thoroughly.

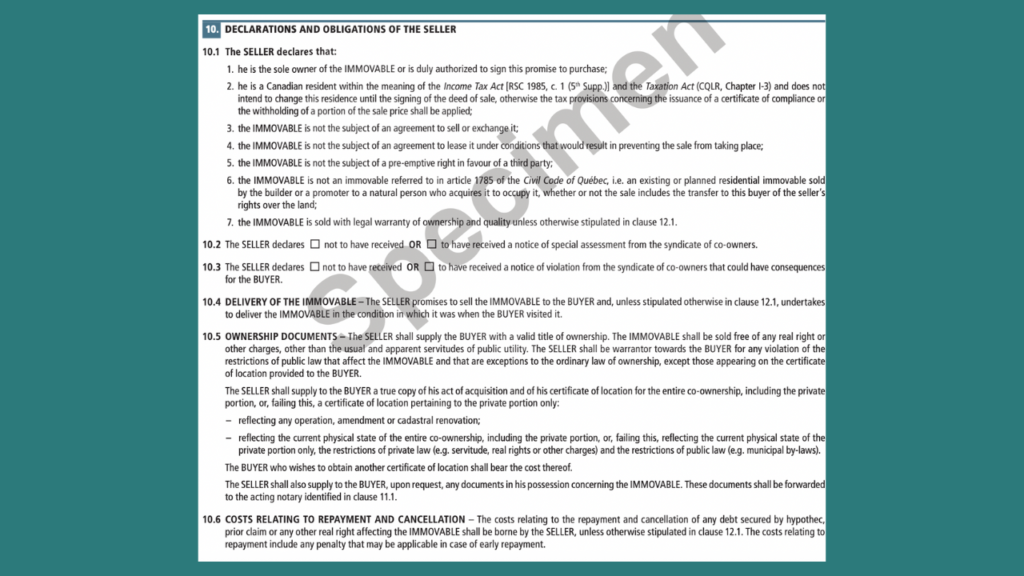

10. Declaration and obligations of the seller

Section 10 covers the declarations made by the seller. These are promises about the property’s condition and legal status, carefully chosen by the OACIQ to give you confidence in proceeding with the purchase. For example, the seller declares that they are the sole owner of the property and that they are a Canadian resident. They also disclose any expected significant expenses, confirm that they will deliver the property in the same condition you visited it in, transfer the property title to you, and make several other commitments that ensure the transaction proceeds smoothly and securely.

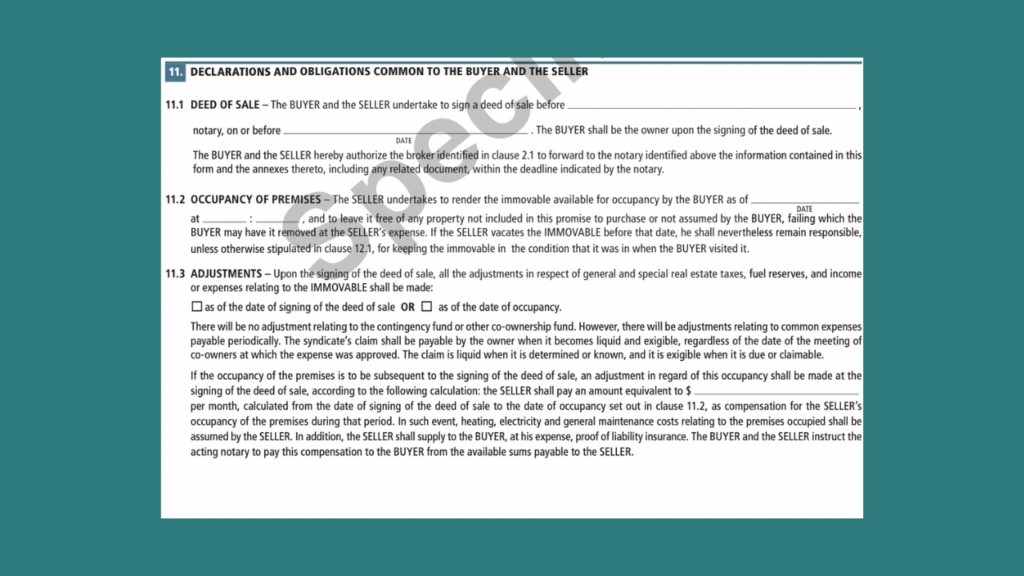

11. Declarations and obligations common to the buyer and seller

Covers mutual obligations, like cooperating with the notary, respecting timelines, and signing all necessary paperwork.

12. Other declarations and conditions

A catch-all section where any additional clauses can be added for example, requests for repairs, inclusion of specific furniture, or sale conditions tied to another transaction.

13. Annexes

Lists any extra documents attached to the offer like building inspection reports, financial pre-approvals, or special agreements.

14. Conditions of acceptance

Specifies the deadline by which the seller must accept the offer and how the acceptance will be communicated.

15. Interpretation

Clarifies how the document should be legally interpreted in case of ambiguity, ensuring both parties understand the terms the same way.

16. Signatures

The final section where both the buyer and seller sign and date the document, making the promise to purchase legally binding.

Frequently asked questions

1. If the offer is rescinded before the seller receives it;

2. If there is an escape or cancellation clause already included in the contract;

3. If an agreement is reached between the parties;

4. If one of the conditions in the contract isn’t met.

Final remarks

The promise to purchase communicates your offer to buy a property. Whilst the promise to purchase differs according to the type of property e.g. detached house vs a plex, there are 16 core sections that are universal to all promise to purchase contracts.

Each section gives the buyer an opportunity to negotiate not just on price, but on timelines, conditions, and risk. In many ways, submitting a promise to purchase is the first formal move in the negotiation process.

Strong negotiation, however, starts before the offer is written. Experienced brokers research the seller and the property to identify factors that may influence the seller’s flexibility. This might include how long the property has been on the market, whether the asking price aligns with comparable sales, or whether public records suggest financial or timing pressures.

While no two situations are the same, understanding the seller’s position helps you structure an offer that reflects where you may (or may not) have leverage. The promise to purchase then becomes the tool you use to test that leverage and adjust your strategy based on the seller’s response.