Canadian home buyers must pay tax on newly built homes or on homes that have undergone substantial renovations. The government charges tax as a percentage of the purchase price, which can reach 15% and add tens of thousands of dollars to the cost of the home.

However, under the New Housing Rebate program from the federal government, you may be eligible for a rebate on the Goods and Services Tax (GST) or Harmonized Sales Tax (HST). This program can offer substantial savings on the cost of buying a new home.

In this article we cover:

- What is the GST/HST New Housing Rebate?

- How much tax can you get back?

- Who is eligible for the GST New Housing Rebate?

- How to apply for the GST New Housing Rebate?

- GST tax relief for first time buyers

- Frequently asked questions about the New Housing Rebate in Canada

- Final remarks

What Is the GST/HST New Housing Rebate?

The New Housing Rebate is a Canadian government program that partially refunds the sales tax on new or substantially renovated homes. When buying these homes, you must pay both federal and provincial sales tax. In most provinces, you pay a Harmonized Sales Tax (HST) that is administered federally by the CRA. The HST is a combination of both the federal GST and the local provincial rate. For example, in Ontario, you will pay 5% federal GST and 8% provincial tax for a total of 13%. The New Housing Rebate allows you to claim back the federal portion, i.e., the GST, on your purchase.

For example, let’s say you buy a new home in Ontario for a purchase price of $750,000. The total HST would be approximately $97,500. In many cases, the price shown by the builder or on the MLS already includes this tax, but the tax still forms part of the overall cost of the home.

The GST/HST New Housing Rebate allows eligible buyers to recover part of the federal portion (the 5% GST). Understanding how this rebate works is key if you want to reduce your effective purchase price and get more value from your new home.

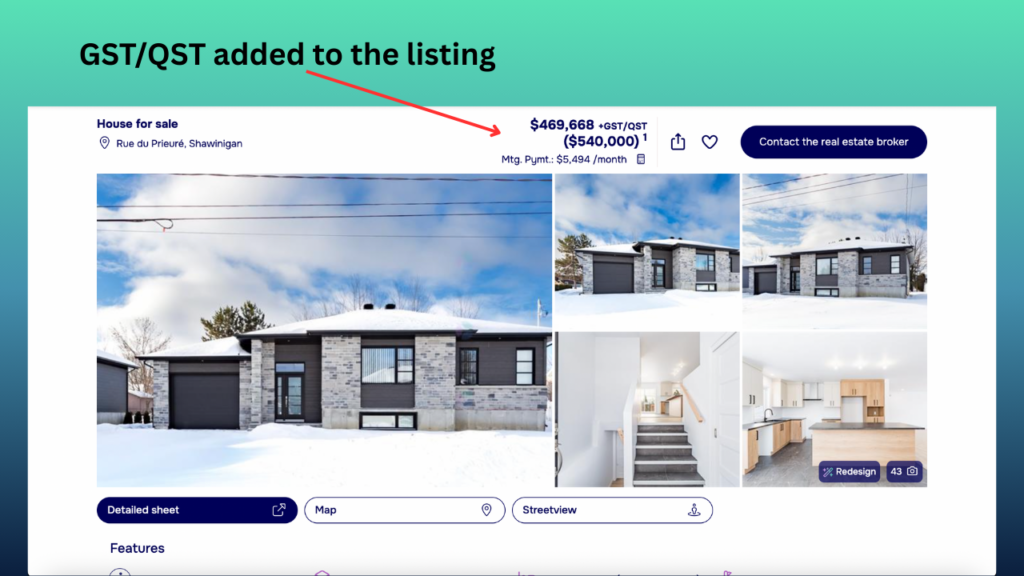

Note on Quebec's HST/QST Rebate

For more information on Quebec’s HST/QST Rebate, check out our article GST/QST Rebate for New Housing in Quebec.

How much tax can you get back?

The amount of tax that you can get back depends on several factors including the tax paid, purchase price and the province in which you buy. In short:

- You can claim up to 36% of the GST paid, up to a maximum of $6,300.

- If your home costs between $350,000 and $449,999, the rebate amount gradually decreases.

- Homes priced at $450,000 or more are not eligible for the rebate.

In short: The lower the purchase price, the larger the rebate you can receive. However, there are also several other factors that determine when and how much of a tax rebate you can receive, these include:

Provincial refunds

In addition to the GST rebate, some provinces provide a refund on the provincial portion of the sales tax paid on new homes. Participating provinces include Nova Scotia and Ontario.

- Ontario Rebate – Ontario offers a new housing rebate of up to $24,000 on the provincial portion of the HST.

- Nova Scotia Rebate – Nova Scotia provides a First-Time Home Buyers Rebate of up to $3,000, available only to first-time buyers and not to renovated homes.

As mentioned above, Quebec’s GST/QST rebate works differently from the rest of Canada. While most provinces use a harmonized sales tax (HST) administered by the CRA, Quebec applies its own Quebec Sales Tax (QST), which Revenu Québec administers separately. Under Quebec’s new housing rebate program, Revenu Québec refunds up to 50% of the QST paid, to a maximum of $9,975. The rebate amount gradually decreases when the home’s purchase price or fair market value exceeds $200,000, and homes valued at $300,000 or more are not eligible for the QST rebate.

In short, certain provinces allow you to recover more tax through additional provincial rebates, beyond the federal GST New Housing Rebate.

Owner-built homes

Owner-built homes can still qualify for the GST/HST New Housing Rebate, but the process is more complex. Since you are building the home from scratch, you pay tax on all of the labour and materials that you require in order to complete the home. This tax is paid as you develop the home. Once the home has been completed, you can then apply for the GST/HST New Housing Rebate and this will re-imberse you for part of the tax paid during construction.

In general, owner-built rebates require more documentation than buying a new home from a builder. You will need to provide invoices, proof of tax paid, and construction dates. You also need to watch filing deadlines and consider your builder status, as the CRA may treat you differently than a standard homebuyer.

Substantial renovations & conversions

For GST/HST purposes, a renovation qualifies as substantial only if you remove or replace 90% or more of the interior of the existing home (excluding the foundation, exterior walls, roof, and structural framing). Cosmetic upgrades such as kitchens, bathrooms, flooring, or windows do not qualify, even if they are expensive.

For instance, let’s say you live in a two bedroom house with one bathroom, a kitchen and dining room. If you refloor the entire house, rennovate the kitchen and bathroom and repaint the entire home, the CRA would not consider this as a “substantial renovation”. Instead, the CRA considers substantial renovations to be projects that remove or replace nearly all of the home’s interior. This would include gutting the house to the studs, removing most interior walls and ceilings, and rebuilding the interior layout almost entirely.

As with owner-built homes, when making substantial renovations and conversions, you pay GST/HST on materials and labor upfront. You therefore need to keep all receipts, and then apply for the rebate once the project is complete.

What is considered substantial?

Who is eligible for the GST New Housing Rebate?

The GST New Housing Rebate is available to people buying or building a new home, or substantially renovating a home that already exists. The buyer or builder must intend to make the home their primary place of residence for themselves or a family member at the time of purchase, construction, or renovation. This means you cannot claim the rebate if you plan to live there only temporarily, rent it out, or sell it immediately after completing the purchase or renovation.

There can be more than one buyer however, at least one buyer must meet the primary residence requirement. Partnerships and corporations cannot claim the rebate, and individuals who purchase through a partnership or corporation may lose eligibility.

Buyers Note

How to apply for the GST New Housing Rebate?

To apply for the GST New Housing Rebate, we recommend that you take the following steps.

- Determine your base date

- The “base date” is usually the date the home is purchased, substantially completed, or occupied, depending on your situation. The date that the home is purchased is the date that you signed the deed of sale.

- You must submit your rebate application within 2 years of this date.

- Collect the required documents

- Keep all receipts, invoices, contracts, and proof of GST/HST paid.

- For new homes, request the certificate of approval or purchase documents from the builder.

- For substantial renovations or owner-built homes, document all materials, subcontractor costs, and taxes paid.

- Complete the correct form

- Purchased from a builder: Use the GST190 form for federal rebate; provincial forms vary (e.g., Revenu Québec form for QST).

- Owner-built home: Use the GST191 form for federal rebate; again, provincial forms apply if claiming provincial rebates.

- Submit the application

- Submit your completed form directly to the CRA (federal rebate) or Revenu Québec (for QST or provincial rebate) depending on your province.

- Include all supporting documentation to avoid delays.

- Processing and payment

- Once approved, the CRA or Revenu Québec will issue the rebate directly to you.

- Processing times vary; CRA typically processes within 8–12 weeks, but it can take longer for owner-built or substantial renovation claims.

GST tax relief for first time buyers

The federal government of Canada made a proposal on May 27th, 2025, that outlined a new GST relief for first-time homebuyers. If accepted, the proposal will eliminate the federal GST on new homes up to $1 million and gradually phase out the rebate on homes priced between $1 million and $1.5 million. For example, a home priced halfway between $1 million and $1.5 million would qualify for roughly 50% of the maximum rebate. The First-Time Home Buyers GST rebate could save buyers up to $50,000 on a new home, depending on the purchase price.

To qualify:

- You must be considered a first-time buyer.

- Be a Canadian citizen or a permanent resident of Canada

- Not have lived in a home in or outside of Canada that was owned by you or a spouse/common-law partner in the calendar year or the 4 preceding calendar years.

- Buy a new home from a builder;

- Build or hire someone to build a home on land you own or lease; or

- Buy shares of a co-operative housing corporation.

Frequently asked questions about the New Housing Rebate in Canada

Final remarks

Buying a home is expensive and complex, but the GST/HST New Housing Rebate can help you save thousands on a new or substantially renovated property. Understanding your eligibility is crucial to getting the most value from your purchase.

Before buying, make sure you confirm your eligibility and have your realtor obtain the appropriate certificates to prove that the home qualifies for the rebate. If you are buying in Quebec, the OACIQ requires that the buyer’s broker verify the property’s certification.

Taking these steps ensures you don’t make costly mistakes and that you don’t leave money on the table.

Need an expert?

The best realtors know how to access financial programs to get the most value from your home purchase. They leverage their networks of financial advisors, mortgage experts, marketing experience and industry connections to make sure you get the best deal for you. That’s why it’s crucial to work with a specialist realtor. One who truly understands your needs and the market.

In Quebec, there are 17,000+ agents.

At Immovision, we scan the market to find the top-performing, active agents who are the perfect fit for your specific project. Once we identify them, we connect you directly with these agents so you can make confident, informed decisions.

Find your ideal agent today and maximize your home-buying power.