One of the most common questions that we get at Immovision is, what is a duplex?

The term can be confusing because owners can legally convert a duplex into a townhouse or into individual rental units. However, at its core, a duplex is a distinct residential property type, and one of the more intricate forms of homeownership in Quebec.

In this article we will cover:

- What is a duplex?

- What is the difference between a duplex and a semi-detached?

- What is a legal non-conforming duplex?

- Pros and cons of buying a duplex (at a glance)

- What are the advantages of buying a duplex?

- What are the disadvantages of buying a duplex?

- Is a duplex a good investment?

- How to know if a duplex is legal or not?

What is a duplex?

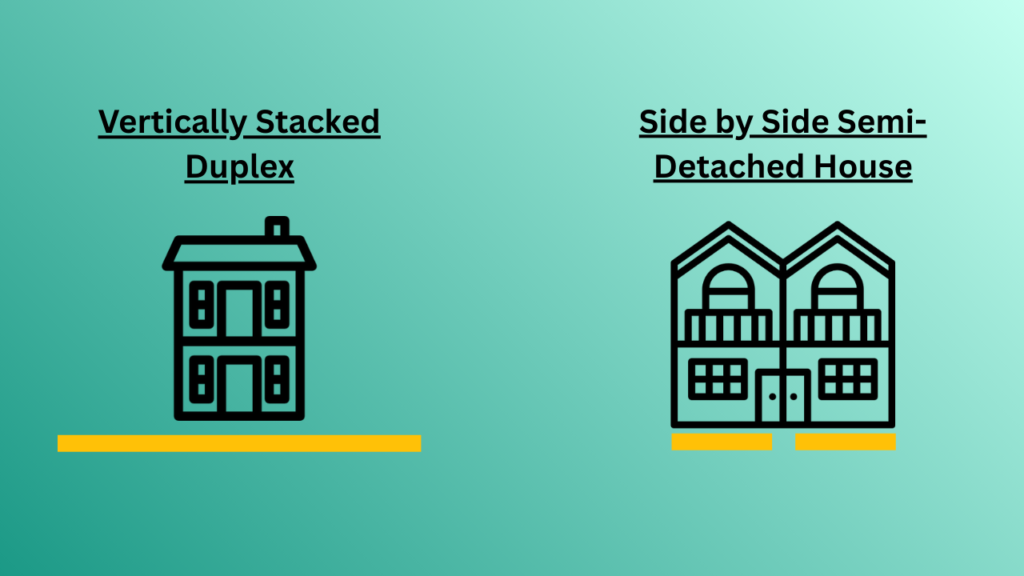

A duplex is a residential building that contains two separate dwelling units within a single structure. Each unit has its own kitchen, bathroom, and living space. Builders usually stack the units vertically or arrange them side by side.

In Quebec, owners typically hold a duplex under one title and one lot number. This means that a single owner owns the entire building. Many owners live in one unit and rent out the other. This makes duplexes a common entry point into plex ownership and small-scale real estate investing.

What is the difference between a duplex and a semi-detached?

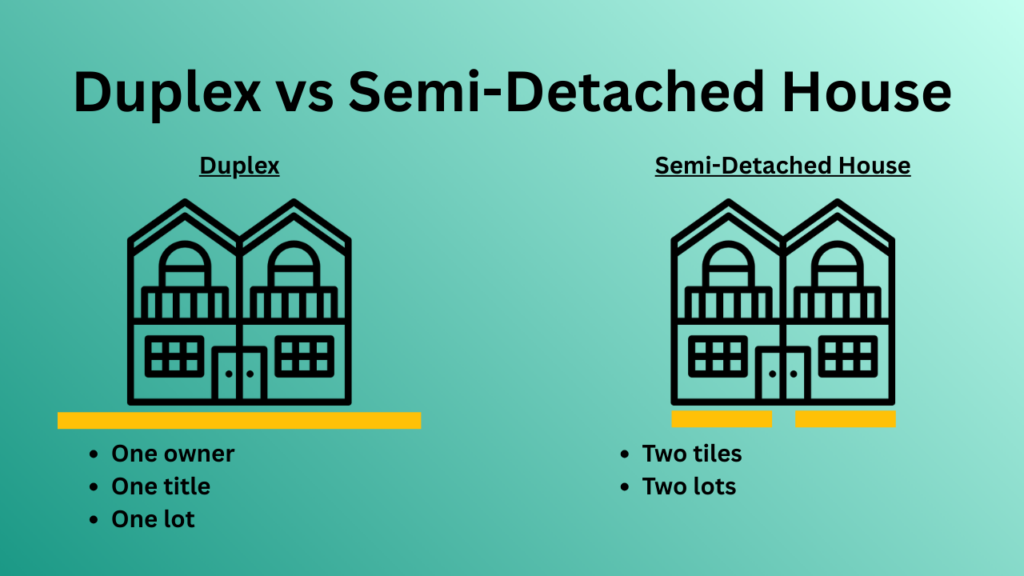

The main differences between a duplex and a semi-detached house are in the;

- Ownership structure

- Unit configuration

- Purpose and use.

In terms of ownership, even if it looks like a semi-detached house, a duplex has one owner, one title, and one lot. This applies to duplexes with units stacked on top of each other or arranged side by side. Meanwhile, a semi-detached house shares one common wall but, each dwelling sits on its own separate lot with its own deed.

Semi-detached houses and duplexes often take different physical forms. For instance, duplexes normally stack vertically, while semi-detached houses sit side by side.

Lastly, people most commonly view a duplex as an investment or multi-generational property. An owner typically lives in one unit and rents out the other to cover mortgage costs. This is the owner-occupied model. By contrast, people tend to view a semi-detached house as a single-family home. While you can rent out rooms or part of the home, you cannot create a separate rental unit. Doing so requires zoning approval, building permits, and compliance with municipal rules.

What is a legal non-conforming duplex?

In Quebec, a legal non-conforming duplex is a building that does not meet current zoning or building rules. Even though it does not meet current rules, the law still allows the duplex to exist because builders constructed it before those rules took effect.

For example, if a neighbourhood now allows only single-family homes, a pre-existing duplex can continue to operate as a duplex. This status allows older properties to continue operating without complying with rules that didn’t exist when they were built.

However, there are rules that still restrict what you can do with a non-conforming duplex. For instance, while you can continue to use the building as a duplex, you usually cannot: expand it, add extra units, or make changes that would violate current zoning.

Furthermore, the municipality can revoke the duplex’s non-conforming status if you leave it vacant or stop using it as a multi-unit property for an extended period. Essentially, a legal non-conforming duplex gives you the right to keep operating an older duplex in a way that current laws wouldn’t normally allow, but it doesn’t give you unlimited flexibility to alter or expand the building.

What is "Droits Acquis"?

Risks of a legal non-conforming duplex

While a legal non-conforming duplex offers valuable rights, buyers should be aware of several key risks.

- First, the municipality can revoke non-conforming rights if you substantially destroy the building. For instance, if there is a fire, or if you stop using it as a duplex. In this case, any new construction to rebuild would then have to follow current bylaws.

- Second, it is the owner’s responsibility to prove that the property has droits acquis. Buyers should ask the borough’s Direction de l’aménagement urbain (DAUSE) to issue a Compliance Letter confirming the status.

- Finally, some lenders may be hesitant to finance a non-conforming property. This is because, lenders may worry that the city will eventually require a change of use, reducing the property’s income potential.

Understanding these risks upfront helps you make a confident and informed decision when buying a legal non-conforming duplex.

Buyers Tip

Pros and cons of buying a duplex (at a glance)

| Pros of owning a duplex | Cons of owning a duplex |

| Owner-occupancy model | Living close to tenants |

| Lower barriers to entry | Management and maintenance responsibilities |

| Great investment properties | Zoning and bylaw risks |

| Tax advantages | Higher financial risk |

| Multi-generational living |

Now that we have a view on what are the pros and cons of owning a plex, let’s take a closer look at each point.

What are the advantages of buying a duplex?

In this section we take a dive deep into the following advantages of buying a duplex.

- Owner-occupancy model

- Lower barriers to entry

- Great investment properties

- Tax advantages

- Multi-generational living

Owner-occupancy model

The owner-occupancy model is when the property owner lives in one of the units of the duplex while renting out the other units. In this situation, the owner-occupant earns income by renting out the other units as rental units. This model allows for faster wealth creation for three main reasons:

- Choosing the owner-occupancy model can reduce the required down payment to as low as 5% on a duplex. This makes it easier to purchase a more valuable duplex. By contrast, buying a duplex as a pure rental property requires a minimum 20% down payment. This significantly increases the upfront capital needed to buy a rental property.

- You can use the rental income to help offset mortgage, taxes, and maintenance costs. This can substantially lower the total monthly housing costs. In addition, the projected rental income also counts towards your total income. This means that a lender can use this in your mortgage application to improve your GDS ratio and TDS ratio. This means that you can qualify for a larger mortgage.

- Rental income can help build up equity faster. In Montreal, the average rent price in 2025 was $1,930. This represents a 71% increase compared to six years earlier. What this means is that a single unit in a duplex will make you approximately $23,000 in annual income. You can use this to pay down the mortgage faster, reduce out-of-pocket expenses, and build equity more quickly.

Lower barriers to entry

Lenders will often allow you to count projected rental income as income when applying for a mortgage. This can enable you to qualify for a significantly larger mortgage than if you were purchasing say a detached home on your own income alone. To illustrate this, consider the following two scenarios showing how the same income can help you qualify for different mortgage amounts for a duplex vs a detached home. In the example, we assume the buyer earns $100,000 and the lender offers a mortgage equal to 4.2 times their annual income.

Step 1: Income Used for Mortgage Qualification

| Detached House | Owner-Occupied Duplex | |

|---|---|---|

| Employment income | $100,000 | $100,000 |

| Annual rental income | — | $24,000 ($2,000/month) |

| % of rent counted by lender | — | 50% |

| Rental income added to qualification | $0 | $12,000 |

| Total income used by lender | $100,000 | $112,000 |

Step 2: Mortgage Amount Based on 4.2× Income

| Detached House | Owner-Occupied Duplex | |

|---|---|---|

| Income used for qualification | $100,000 | $112,000 |

| Mortgage multiple | 4.2× | 4.2× |

| Maximum mortgage | $420,000 | $470,400 |

As you can see, the owner-occupied duplex model allows a borrower to qualify for a mortgage of approximately $470,400. This is more than $50k higher than what would be possible without counting rental income.

Great investment properties

Many Canadian investors see duplexes as accessible entry‑level investment properties because, rental income from one or both of the units can help

- (A) apply for a larger mortgage;

- (B) cover mortgage expenses and

- (C) accelerate equity growth.

In addition, duplexes offer the advantage of shared maintenance across units. Owners can spread costs like roof repairs, snow removal, and general upkeep across multiple units, lowering the maintenance burden on each property. This allows owners to retain more rental income as profit or reinvest it into the property, boosting cash flow and long-term returns.

Finally, buyers often value a duplex based on the income it generates rather than just comparable sales (or “comps”). This means that the property’s market value directly reflects the rent its units can produce. As such, improvements that increase rental income and reduce maintenance costs such as renovations can directly increase the property’s value. This means you have the ability to make strategic, income-driven decisions that grow your equity faster than the market. It also gives you more control over your investment’s performance vs the market.

House Hacking

Tax advantages

Owning a duplex can offer several tax advantages, especially if you live in one unit and rent out the other. For instance, you can deduct many expenses related to the rental unit from your rental income. This includes mortgage interest, property taxes, insurance, and repairs. This reduces your overall taxable income.

You can also claim depreciation (Capital Cost Allowance) on the building portion of the rental unit. The building portion includes everything except for the land that the property sits on. Depreciation is a way to account for the fact that buildings slowly wear out over time. The government lets you treat this loss of value as a tax deduction. Since you only rent out part of your property, you apply the deduction just to the rental portion. This lowers your taxes, increases your cash flow, and helps you build equity faster.

Buyers Note

Multi-generational living

Duplexes are perfect for multi-generational living. This is when parents, adult children, or grandparents can live under one roof in separate units. Each household keeps its privacy while still sharing support and resources.

This setup reduces housing costs by splitting mortgage, taxes, and utilities. It also provides a built-in support system for childcare, eldercare, or household chores. Lastly, it offers flexibility. For instance, if a family member moves out, you can rent the unit for extra income.

What are the disadvantages of buying a duplex?

In this section we dive deeper into some of the downsides of buying a duplex.

- Living close to tenants

- Management and maintenance responsibilities

- Zoning and bylaw risks

- Higher financial risk

Living close to tenants

Living close to tenants allows you to monitor exactly how they use your property. For example, you can quickly notice if tenants overcrowd a unit, if unauthorized occupants move in, if tenants operate short-term rentals (like Airbnb) without permission, or if they neglect upkeep, causing water leaks, excessive humidity, or unsafe modifications.

However, on the flip side, living in close proximity to your tenants often leads to more frequent requests.

Tenants who live next door are more likely to raise minor issues (such as replacing light bulbs) in person, rather than handling them themselves or reporting them through formal channels. In addition to this, disagreements over rent increases, late payments, or lease enforcement can become more personal and harder to manage when you live in the same building. For instance, imagine enforcing a rent increase recommended by the Tribunal administratif du logement (also know as TAL) with a tenant you share an entrance or backyard with. In this case, even routine administrative matters can become socially awkward when you live under the same roof.

Buyers Tip

Management and maintenance responsibilities

As an owner-occupant of a duplex, there are additional legal and administrative obligations that you must be aware of. This is because, you are both a homeowner and the operator of a regulated rental business. This will make life more complex than living in (for example) a townhouse where you are only responsible for your unit.

As an owner-occupant, you take on legal responsibilities toward your tenants, including ensuring they have “peaceable enjoyment” of their unit. This means staying on top of maintenance and promptly fixing any issues that make the unit unsafe, unhealthy, or uncomfortable. For example you must fix a broken heater, plumbing leaks, or pest problems immediately. If you ignore or delay repairs this can lead to legal consequences, fines, or claims at the TAL.

In addition to this, you must follow proper procedures for rent increases or evictions. You cannot simply change locks or shut off services when a tenant doesn’t pay rent or refuses to leave at the end of their lease. In all cases, you must legally comply with Quebec’s tenancy laws and municipal regulations. This means that any disputes, non-payment issues, or lease violations must go through the TAL.

As an owner-occupant, you are also responsible for the day-to-day administration of a small rental property. This includes preparing compliant Quebec leases, tracking lease renewals, and rent increase deadlines. It also means keeping records of rent payments and repairs, and communicating with tenants in writing when required. If issues arise, you must follow formal procedures through the TAL and handle maintenance, inspections, insurance, and compliance with municipal bylaws.

Buyers Tip

Zoning and bylaw risks

Municipal zoning and bylaws determine what you can do with your property. Whilst these rules apply to any type of property, duplexes are generally subject to higher degrees of regulation. This is because multi-unit properties (including duplexes) form the backbone of rental housing supply in urban areas. If there are fewer rental properties, this pushes up the prices of remaining rental units. This can negatively impact the local economy as a whole since, higher housing costs make it harder for workers to live near their jobs and support local businesses.

As such, municipalities often impose stricter zoning regulations on duplexes than on single-family homes to control population density, ensure safety, and manage housing availability. These rules limit what you can do with a duplex. For example, converting it into a single-family home could reduce rental supply, so Montreal municipalities have strict regulations to prevent this. Before selling a unit, adding new units, converting spaces, or altering the building’s exterior, you must check the municipal zoning and bylaws. You should also confirm that any previous modifications comply with the rules.

Buyers Note

Higher financial risk

Owning a duplex carries higher financial risks because you’re more leveraged and reliant on rental income. For example, if for whatever reason your tenant does not pay rent, you still have to pay the mortgage. This can effectively double the cost of your mortgage from one month to the next. The same applies if you have several months where you cannot find a tenant.

You will also have higher repair costs than living in a single-family home. This is because you are responsible for more living space and multiple units, which means more plumbing, electrical, heating, and general maintenance issues. If you don’t stay on top of these responsibilities, you could face financial penalties from the TAL, which can further compound any stress on your monthly cash flow.

Lastly, because you are highly leveraged, you will feel rising property taxes much more. Even a modest percentage increase can translate into a significant expense relative to your income. For example, a 0.5% increase in property taxes on a $1.5 million duplex adds $7,500 per year to your costs. The same applies to monthly insurance premiums.

Therefore, while rental income can amplify your returns, it also amplifies potential financial challenges. This is not to say don’t take on this risk, but you will need to actively manage it.

Is a duplex a good investment?

Most people buy duplexes for one of two reasons. Either as investors seeking rental income, or as house hackers (first time buyers) who live in one unit while renting the other to reduce housing costs and build equity.

For first-time investors, a duplex can be a great entry point into multi-unit real estate. It offers diversified rental income within a single property and typically costs less than larger plexes. However, duplex values often rise more slowly than single-family homes because fewer buyers compete for them, and their prices depend more on rental income than on emotional demand. This is why many investors choose duplexes over townhouses: they prefer assets where cash flow and income potential matter more than comparable home sales.

For house hackers, a duplex can be especially powerful. Living in one unit allows you to qualify with a lower down payment while using rental income from the second unit to offset mortgage costs and build equity faster. That said, it’s not passive income. You’re a landlord, often living next door to your tenant, with legal responsibilities and day-to-day management to consider.

All that being said, owning a duplex lets you start investing in Quebec real estate in a simple and accessible way. You can live in one unit and rent out the other. This setup can turn your home into a smart investment. For example, imagine that your monthly costs for mortgage, taxes, and maintenance total $3,000, and you rent the second unit for $1,800. In this case the rental income covers more than half your housing expenses. As you pay down the mortgage, you also build equity in the property, reducing your costs while increasing your ownership stake for the future. Therefore a duplex lets you live comfortably while your investment grows, making it a practical, financially savvy way to enter the real estate market.

How to know if a duplex is legal or not in Montreal?

A legal duplex is a two-unit building that meets all zoning rules and has all construction and renovations approved by the city. To know if a duplex is legal in Quebec, you need to check that it complies with current zoning and building rules, or, if it doesn’t, that it has legal non-conforming status. It is important to check this because a non-legal duplex can lead to fines, forced renovations, financing and insurance issues, and complications when selling the property.

We will use the rest of this section to show you how to check if a duplex is legal in Montreal.

1. Check the municipal zoning rules

Purpose: Check the municipal zoning rules to find out if a duplex is permitted in the area.

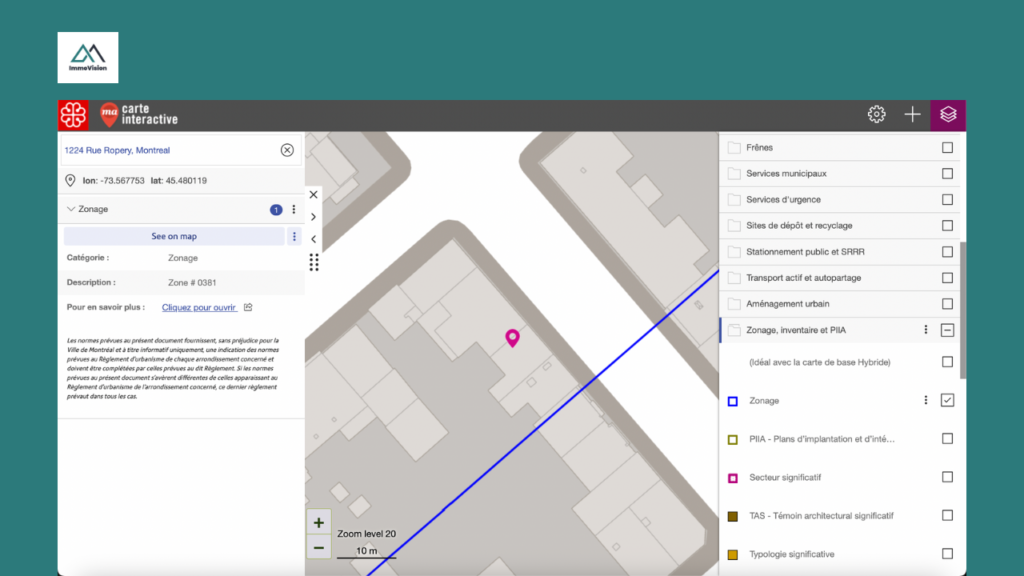

To do this, visit the Spectrum Interactive Map or the Land Use Planning Interactive Map. The image below shows an example of a search run on Spectrum Interactive Map. The step by step instructions on how to verify on Spectrum Interactive Map are below the image.

- Locate Property: Enter the address in the top-left search bar.

- Select Borough: Use the top-right dropdown to choose the correct borough (e.g., Le Sud-Ouest).

- Activate Zoning Layer: Select the “Zonage” category from the bottom-right menu.

- Identify Zone: Click on the property to see a pop-up with the Zone Number (e.g., 0381) and the Zoning Grid link (Grille des usages et des normes).

- Download and Read PDF: Open the PDF and look for the residential code (e.g., H.1-4 means 1 to 4 units are allowed).

Buyers Tip

2. Check building permits

Purpose: Having established that a duplex is allowed to be built, the next step is to check if the building was built with the correct authorization.

You can do this by visiting the Property Assessment Rolls. Enter your address. Look for the “Number of units” (Nombre de logements). If it says “1,” the building is not yet authorized as a duplex, even if you are in a Zone where duplexes are allowed. You can also go to your Borough Permit Counter (like Côte-des-Neiges–NDG or Sud-Ouest) and request a letter attesting to the building’s permit history.

A legal duplex should have permits for all construction and renovations that created separate units, including kitchens, bathrooms, and entrances.

3. Request a compliance letter

Purpose: Now that you have confirmed that zoning allows a duplex and permits exist, the next stepis to obtain a formal, written guarantee from the borough that the property’s current configuration is fully recognized as legal. This is important for older duplexes that might be non-conforming.

To get this, you can request it from the Permit Counter (or whichever borough the property is in). You will need to provide your Certificate of Location prepared by a land surveyor, which describes the building as it stands today.

4. Review the deed and cadastral records

Finally, you want to ensure that the property is listed as a duplex or multi-unit building on official documents.

Frequently asked questions

Looking to buy a duplex?

Duplexes are among the most complex investment types in Quebec. That is why working with a specialist is the smartest move.

Our Immovision matching service connects you with brokers who know Quebec inside out. They understand zoning and bylaws as they pertain to duplexes, and can spot opportunities like non-conforming units. We scan over 17,000 agents to make sure you get a professional who is actively buying and selling duplexes in Quebec, can navigate the market confidently, and help you secure the right duplex quickly and efficiently.

Click the link below to find the top Quebec duplex specialists and connect with the right broker now.