Welcome tax, is not actually a “welcome tax” at all. It is a land transfer tax that you must pay whenever you buy a new property in Quebec. It often represents the biggest item in a buyer’s closing costs and must be carefully budgeted for. In this article, we cover:

- What is welcome tax?

- Why do Quebecers call it welcome tax?

- How to calculate the welcome tax

- Why do you have to pay welcome tax

- Which municipality has the highest welcome tax rate?

- Final remarks

What is the “welcome tax”?

In Quebec, the “welcome tax” is the nickname that Quebecers use for the Land Transfer Tax. It is a land transfer duty that you must pay when you buy a property in Quebec. The municipality where you buy the home charges the tax and uses it to fund local infrastructure and services, including road repairs, public transit, parks, libraries, and emergency services. You pay welcome tax only once, at the time of transfer or ownership. But you will pay it on every house purchase that you make. It is not just for first time buyers.

Why do Quebecers call it welcome tax?

Quebecers call the land transfer tax the “welcome tax” ironically. It is a nod to Minister Jean Bienvenue, who campaigned for the introduction of the land transfer tax in the 1970s. Jean’s surname “Bienvenue” literally means “welcome” in French. As such the local French speaking Quebecers started calling it the “taxe de bienvenue” which translates to “welcome tax” and the nickname stuck.

How to calculate welcome tax?

In Quebec, welcome tax is a progressive tax, meaning that the more valuable the property, the higher the marginal rate. The municipality that calculates it will use the higher of the assessed value or the purchase price to determine the property’s value.

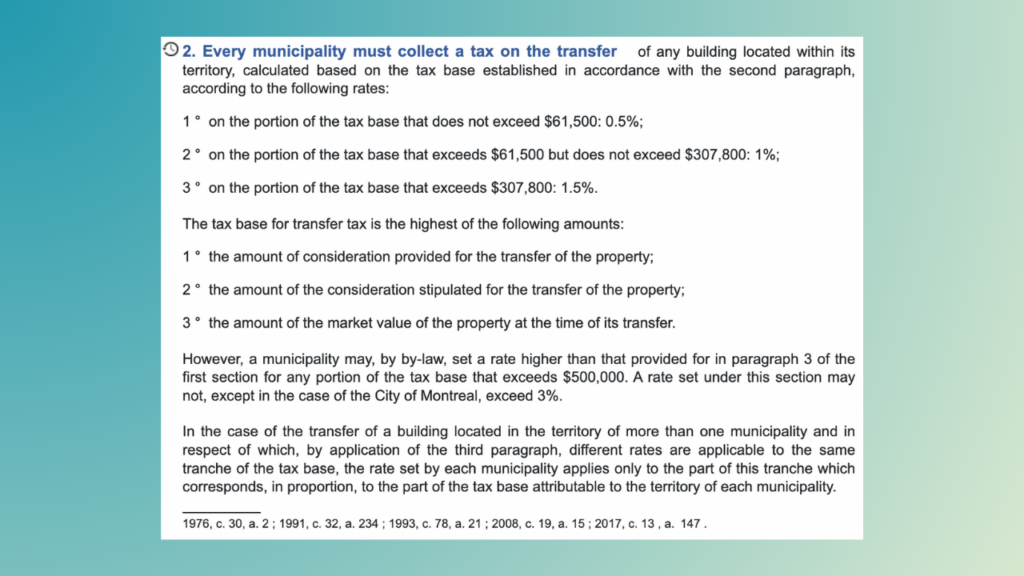

Each municipality, except for those that are in an Urban Agglomeration, can set its own marginal tax rate. However these rates must sit within the tax brackets set out within Quebec’s provincial framework (the Law Concerning Taxes on Real-Estate Transfers). Article 2 makes reference to the different tax brackets and how much municipalities can add on top of the provincial base rates.

As you can see in the image above, the base tax rates are:

| Portion of Tax Base | Rate |

|---|---|

| Up to $61,500 | 0.5% |

| $61,500.01 – $307,800 | 1% |

| Over $307,800 | 1.5% |

Municipalities may increase the rate on any portion of the property value above $500,000 by up to 3%. The City of Montreal is the only exception and may set rates higher than 3% for high-value properties. And, if a property spans more than one municipality, each municipality applies its rate proportionally to the portion of the property in its territory.

Each municipality publishes their own welcome tax on their municipality websites, links below.

Why do you have to pay your welcome tax?

In the late 1970s, Quebec municipalities were struggling financially. They needed a new, stable source of revenue beyond annual property taxes. To address this problem, the provincial government of Quebec passed legislation allowing municipalities to collect a tax on property transfers. The goal was to ensure that every time a property changed hands (often at a higher value), the municipality could capture some of that increased wealth to help fund local services.

In addition to welcome tax, the government of Canada also charges a federal Goods and Services Tax (GST) on all new or substantially renovated property sales. The Quebec provincial government also charges their own Quebec Sales Tax (QST) on new or substantially renovated property sales.

Which municipality has the highest welcome tax rate?

Montreal, Laval, Longueuil, and a few others have adopted higher luxury brackets (like the 3.5% rate on properties over $2 million).

Final remarks

Welcome tax is a land transfer duty you must pay when you buy a property in Quebec. It is usually the largest expense in a buyer’s closing costs. Although paying the welcome tax can feel steep, it funds improvements and services in the area where you buy. In addition, there are tax rebate programs to help offset the cost. To see the impact of the welcome tax on your closing costs, use the Immovision closing cost calculator. This will help you to accurately budget for the cost of buying a new home.