So you’re saving up for the down payment on your first home in Quebec, but did you know there are government programs designed to speed that up?

From the FHSA to the HBP and RRSP, each one promises tax advantages that can significantly boost your savings.

In this article we are going to look at the pros and cons of opening a First Home Savings Account (FSHA) and, most importantly, is it right for you, and how can you maximize the benefits of a FHSA.

More specifically we will cover:

- What is the FHSA?

- Pros and cons of opening a FHSA (at a glance)

- What are the advantages of opening a FHSA?

- What are the downsides of the FHSA?

- How to maximize the benefits of the FHSA

What is the First Home Savings Account (FHSA)?

The First Home Savings Account (FHSA) is a registered savings plan introduced by the Government of Canada in 2023 to help Canadians save for their first home purchase. It combines the best features of an RRSP, TFSA and HBP (Home Buyers Plan).

If you have more questions about what is the First Home Savings Account, check out our article First Time Home Savings Account (FHSA) – Everything You Need to Know.

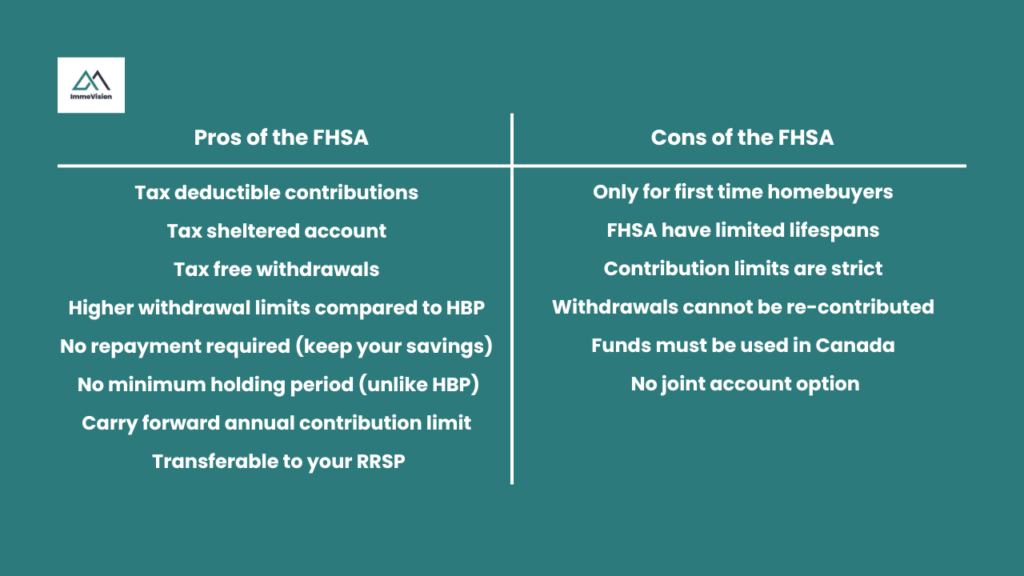

Pros and cons of the FHSA (at a glance)

In general the FHSA is a great thing for first home buyers however, there are several pros and cons of the FHSA. These are displayed below.

What are the advantages of opening a FHSA?

There are several advantages of opening an FHSA for first time home buyers. These include:

- Tax deductible contributions

- Tax sheltered account

- Tax free withdrawals

- Higher withdrawal limits compared to HBP

- No repayment required (keep your savings)

- No minimum holding period (unlike HBP)

- Carry forward annual contribution limit

- Transferable to your RRSP

Let’s take a detailed look at each of these advantages now.

1. Tax deductible contributions

The money that you pay into your FHSA is tax deductible. This means that you will reduce the amount of tax that you pay each year. Below is an example of how this works. This example assumes an annual income of $80,000, and a marginal tax rate of 25%.

| Category | Without FHSA Contribution | With $8,000 FHSA Contribution | Difference |

| Annual Income | $80,000 | $80,000 | — |

| Taxable Income | $80,000 | $72,000 | ↓ $8,000 |

| Tax Rate | 25% | 25% | — |

| Tax Owed | $20,000 | $18,000 | ↓ $2,000 |

| Tax Savings | — | — | $2,000 saved |

As you can see, by contributing $8,000 to your FHSA, you save $2,000 in taxes this year. Furthermore, as we are about to see, your contribution grows tax free until you use it toward your first home.

2. This is a tax sheltered account

Payments made into your FHSA can be invested. Any interest earnt on these savings is completely tax free. This means that you won’t pay any tax on the growth, dividends or capital gains inside your FHSA. This works the same way as for the TFSA and RRSP contributions that you make.

The investment options available in an FHSA are similar to those in an RRSP or TFSA. You can choose to invest in stocks, term deposits, mutual funds, exchange-traded funds (ETFs) and government or corporate bonds

As with other registered accounts, the right mix depends on your personal financial goals and risk tolerance. Be sure to consult your financial institution or advisor to determine which options best suit your situation.

3. Tax free withdrawals

Unlike the RRSP or HBP, which require you to pay tax on the money you withdraw (or repay it later), the FHSA does not require any repayment or taxation. This is provided that the funds are used to buy your first qualifying home.

Furthermore, whilst the lifetime limit on your FHSA is set to $40,000 and the annual limit is set to $8,000, the funds you deposit will earn interest over time. Then, any interest earned can also be added to your down payment and withdrawn completely tax free. For example, let’s say that you earn $5,800 in interest on your $40,000. The total amount you can withdraw tax free is $45,800.

4. Higher withdraw limit compared to the HBP

The Home Buyers Plan (HBP) allows you to withdraw up to $35,000 from your RRSP to help fund the purchase of your home purchase down payment. This is provided the money sits inside your RRSP for at least 90 days before you withdraw it.

By contrast the FHSA allows you to deposit up to $40,000 and then withdraw this entire amount plus any accumulated interest.

Buyers Tip

5. No repayment required (keep your savings)

One of the biggest advantages of the First Home Savings Account (FHSA) over the Home Buyers’ Plan (HBP) is that you never have to pay it back.

When you withdraw funds from your RRSP under the HBP, you’re essentially borrowing from yourself. This means that the money you withdraw must be repaid within 15 years, with at least 1/15 of the withdrawn amount deposited back into your RRSP each year. If you skip a repayment, that portion is added to your taxable income for the year, meaning you’ll owe more tax.

By contrast, any money you withdraw from your FHSA to buy your first home is completely tax free and does not need to be repaid. You keep the full benefit of your savings and investment growth.

Buyers Tip

That’s why it’s important to speak with a financial advisor before deciding whether to use the HBP, the FHSA or both. For example, if you plan to take time off work to start a family or change careers, the HBP repayments could force you back to work earlier than expected. A financial advisor can help you plan the best mix of accounts based on your income, savings goals, and future lifestyle.

6. No minimum holding period (unlike HBP)

One of the most flexible features of the FHSA is that you can use your savings right away. There’s no waiting period between the time you deposit money and when you withdraw it to buy your first home. For example, if you contribute $8,000 to your FHSA today and use it for your down payment tomorrow, you’ll still receive the full tax deduction for that year.

By contrast, the HBP requires funds to sit in your RRSP for at least 90 days before you can withdraw them. This makes the FHSA far more flexible. This is especially the case if you’re close to buying and want to maximize your tax savings at the last minute.

7. Carry forward annual contribution limit

One of the best features of the FHSA is that unused contribution room doesn’t disappear at the end of the year. Instead, if you don’t contribute the full $8,000 annual limit, the remaining amount rolls over to the next year. This is up to the maximum lifetime limit of $40,000. For example, if you only contribute $3,000 in your first year, you can contribute $13,000 the following year ($8,000 for the new year plus $5,000 carried forward).

This flexibility makes the FHSA especially helpful if you’re not ready to buy yet or can’t afford to contribute the full amount right away, since your contribution room will still be waiting for you when you’re financially ready. As such, there is really no downside to opening the FHSA as early as possible.

8. Transferable to your RRSP

If you decide not to buy a home, your FHSA doesn’t go to waste. You can transfer the full balance, including any investment growth, directly into your RRSP (Registered Retirement Savings Plan) without paying any tax and without affecting your RRSP contribution room.

This makes the FHSA one of the most flexible savings tools in Canada. You can think of it as a “no-risk savings vehicle”. If you buy a home, you use it tax-free for your down payment. Alternatively, if you decide not to buy a house, it simply boosts your retirement savings.

WARNING

Always ask your bank or financial advisor to process it as a direct transfer to keep it completely tax-free.

What are the downsides of the FHSA?

The FHSA account is one of the most versatile accounts that you can get. However, there are some restrictions that you need to be aware of when using this investment vehicle. These will help inform how you use the FHSA so that you can maximize its effectiveness. These are:

- Only for first time buyers

- FHSA have limited lifespans

- Contribution limits are strict

- Withdrawals cannot be re-contributed

- Limited if you are close to buying

- Funds must be used in Canada

- No joint account option

Let’s take a quick look at each of these points now.

1. Only for first time buyers

The FHSA is designed exclusively for first-time home buyers, meaning you can only open one if you haven’t owned a home that you lived in during the past four calendar years. This includes homes owned jointly with a spouse or partner.

If you’ve previously owned a home, you can re-qualify only after a four-year period in which neither you nor your spouse/common-law partner lived in a property you owned. For example, if you sold your home in 2020 and have been renting since, you’d become eligible again in 2025.

While this rule ensures the program supports genuine first-time buyers, it can be a drawback for anyone who’s owned property before, even briefly or jointly, since they must wait years before benefiting from the FHSA’s tax advantages.

2. FHSA have limited lifespans

An FHSA can only stay open for 15 years from the date it is opened, or until the end of the year you turn 71 (whichever comes first). This means the account is meant for people planning to buy their first home within a set timeframe, not as a long-term savings vehicle.

If you don’t end up buying a home during that period, you’ll need to transfer your savings to an RRSP or RRIF to keep their tax-sheltered status. Otherwise, you can withdraw the funds, but the amount will be treated as taxable income in the year of withdrawal.

While this rule helps ensure the FHSA is used for its intended purpose, it can be a drawback for savers who delay their purchase or change their plans, since the window to use the account’s benefits is fixed.

Buyers Tip

3. Contribution limits are strict

You can contribute up to $8,000 per year to your FHSA, with a lifetime maximum of $40,000.

While unused contribution room can carry forward to future years, the annual cap still applies meaning that you cannot contribute more than $8,000 in any one calendar year. If you go even $1 over the limit, the CRA charges a 1% monthly tax penalty on the excess amount until it’s withdrawn.

For example, if you accidentally contribute $9,000, you’ll owe $10 per month in penalties until you remove the extra $1,000. Because of this, it’s important to track your contributions carefully, especially if you have multiple accounts or financial institutions managing your FHSA.

Buyers Tip

4. Withdrawals cannot be re-contributed

If you withdraw money from your FHSA for any reason other than buying your first home, the amount becomes taxable income in the year you take it out, and you don’t get that contribution room back. In other words, once you withdraw funds, your lifetime contribution limit of $40,000 does not reset.

For example, if you contributed $20,000 over a few years and later withdrew it without buying a home, you cannot re-deposit that amount later to rebuild your FHSA balance. This makes it important to treat the FHSA as a dedicated home-buying fund, not a general savings account. If you think you might need the money sooner, it’s better to keep those funds in a TFSA where withdrawals are tax-free and your contribution room replenishes automatically the following year.

5. Funds must be used in Canada

The FHSA is designed to help Canadians buy their first home in Canada, not to invest abroad. To qualify for tax-free withdrawals, the home you buy must be located in Canada and be used as your principal residence within one year of purchase or construction.

You will need to submit proof of the home purchase, typically the deed of sale or notarial closing documents whenever making your qualifying withdrawal. This confirms to your financial institution and the CRA that the property meets the program’s requirements.

If you use the funds for a vacation home, rental property or any property outside Canada, the withdrawal will be treated as taxable income and you will lose the FHSA’s tax advantages. While this ensures the program supports genuine first-time home buyers, it can be a drawback for anyone planning to buy or move abroad, since the funds must be used domestically.

6. No joint account option

Unlike a regular savings account, an FHSA can only be opened in one person’s name. This means that there is no joint or shared option for couples.

Each partner in a couple must therefore open their own individual FHSA to benefit from the program. This means that if you’re buying a home together, you can’t pool contributions into a single account. However, this is not a major downside since each partner does get their own $40,000 lifetime limit and so, if you work as a team, you can effectively double your combined tax-free savings potential to $80,000. This is provided that you both qualify as first-time buyers.

Buyers Tip

Conclusion: How to maximize the benefits of your FHSA

The FHSA offers powerful tax advantages, but its real value depends on your personal situation — your income level, timeline to buy, and whether you’re purchasing alone or as a couple. If you plan ahead, you can position yourself strategically to take full advantage of the program. For instance, couples can each open their own FHSA and effectively double their tax-free contribution room. Starting early also lets your investments grow over several years, maximizing the benefit of compounding before you buy.

That said, the FHSA is not a silver bullet when it comes to buying your first home. While it helps you stretch your savings further by keeping your investment growth tax-free and lowering your taxable income, you will still need to commit to consistent saving, smart budgeting and disciplined financial planning. Used wisely, the FHSA is a valuable tool that rewards preparation but, it works best as part of a broader, long-term financial strategy.