Mortgage renewal can be a stressful time for Quebecers. However, this is mainly because the process is not well understood.

Whether you are a first-time homeowner, a seasoned buyer, or someone looking to refinance, if you start early and understand the process, mortgage renewal can actually represent an opportunity to secure better terms, lower your payments, or access equity in your home. In this article, we fully demystify the mortgage renewal process so that you can make informed decisions and avoid paying more than necessary. We will cover:

- What is mortgage renewal?

- How does the mortgage renewal process work?

- When should you start the mortgage renewal process?

- Do mortgages automatically renew?

- Where best to renew your mortgage

- Mortgage renewal rates

- Mortgage renewal strategies to save you time, money and stress

- What happens if your current lender refuses to renew your mortgage?

- Final remarks

What is mortgage renewal?

A mortgage renewal is when you extend your existing mortgage after its term ends by negotiating a new interest rate and term.

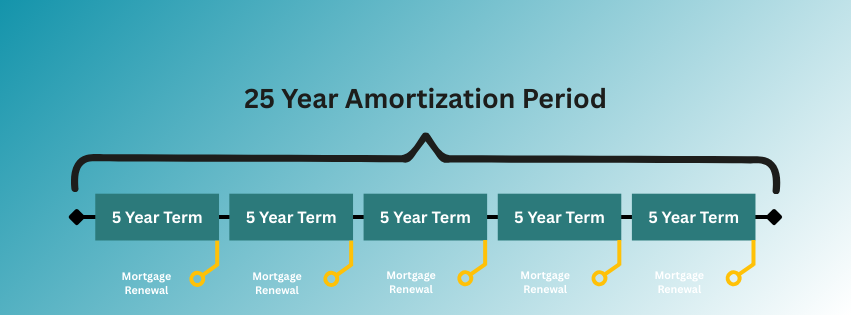

In Canada, the total time you have to pay off your mortgage (called the amortization period) is usually split into several shorter terms. For example, a 25-year amortization period might be made up of five separate 5-year mortgage terms, each requiring a renewal before the mortgage is fully paid off.

How does the mortgage renewal process work?

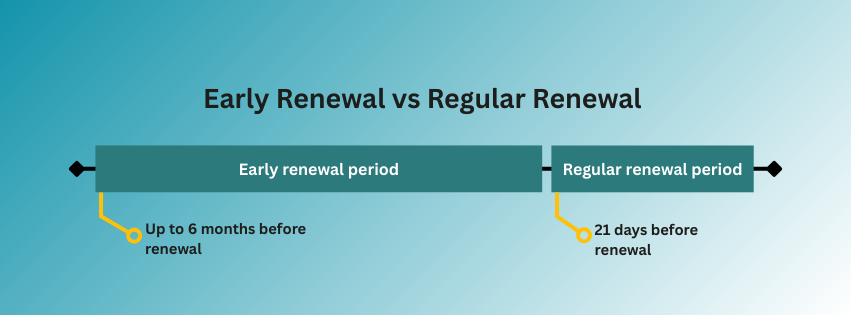

In the months leading up to your mortgage renewal, you can call your lender to understand what their mortgage renewal process is. Most lenders will make a distinction between an early renewal and a regular renewal. An early renewal is when you renew ahead of the mortgage renewal date. Some homeowners choose to do this because it gives them the opportunity to immediately switch onto a lower rate. However, there will normally be financial penalties for breaking the term and renewing early.

A regular renewal takes place in the days leading up to the expiration of your mortgage. In a regular renewal, your lender will send you a renewal offer. This offer will typically include the remaining principal at the renewal date, the interest rate, the payment frequency, the term and any charges or fees that apply. If you are working with a federally regulated lender such as a bank, the offer must also state that the rate offered won’t increase until your renewal date.

At this point, you are free to either accept this offer, negotiate with your lender, or choose to renew with another lender. In each case, you should at least consider the interest rate, term length, payment frequency, and whether the offer aligns with your financial goals.

When should you start the mortgage renewal process?

To get the best deal, you should start the mortgage renewal process sooner rather than later.

If your mortgage is with a federally regulated financial institution such as a bank, the lender is legally required to send you a renewal statement at least 21 days before your renewal date. The lender must also notify you 21 days in advance if they will not renew your mortgage. The renewal statement will be sent to you by mail or electronically, depending on how you’ve chosen to receive communications.

Whilst you will get your renewal statement at least 21 days before the mortgage renewal, some lenders recommend you to start the renewal process up to 4 months before your renewal date. And some lenders will actually allow you to renew up to 6 months early without charging you a pre-payment penalty.

However, it is generally not prudent to renew early with your current lender without first shopping around for a better rate. If you start to shop around 4 – 6 months ahead of your mortgage renewal, you will likely be able to find a better interest rate and mortgage terms with a new lender. You can then use this offer as leverage to negotiate with your current lender. If you start this process early, you will have ample time to negotiate with your current lender.

Do mortgages automatically renew?

Some lenders will automatically renew your mortgage if you do not respond to the renewal offer before the renewal date. The renewal statement that you receive will explain this.

Although an automatic renewal is the least amount of work, it will most likely not yield the best financial decision for you. This is because the renewal offer will most likely include the lender’s default terms and interest rate, which may not be the most competitive or aligned with your current financial goals. For instance, the lender’s automatic renewal could automatically sign you up for a shorter amortization period, increasing your monthly payments and potentially straining your cash flow.

Where best to renew your mortgage

At a high level, you have two options of where to renew your mortgage.

Let’s dive into what each of these scenarios looks like.

Renew with your current lender

Most people choose to renew with their current lender. This is because it offers the path of least resistance for two main reasons. First, whether you accept the first set of terms that the lender offers, or you attempt to negotiate, if you choose to renew with your current lender, you usually don’t need to re-qualify for your mortgage. Second, if your current lender is an A-lender, there are typically no renewal fees whereas, if you choose to renew with a private lender, you may have to pay some upfront fees.

Renew with a new lender

If your current lender is unable (or unwilling) to offer you a lower rate, it may make sense to renew your mortgage with a new lender. This process is more involved, as the new lender will need to re-qualify you. This means that you will need to provide documentation about your income, debts, and financial situation again. However, unlike when you’re getting a brand-new mortgage, lenders in Canada don’t have to apply the full mortgage stress test to borrowers who are simply switching from one lender to another at renewal.

In addition to needing to re-qualify, there are often switching costs that you will need to assess. For example, your new lender may charge for a home appraisal and other administrative fees associated with setting up the new mortgage. Meanwhile, your current lender may charge prepayment or breaking penalties, as well as legal or discharge fees to release your mortgage.

Use our Switching Cost Calculator to find out what the hidden costs are of staying with your existing lender.

Mortgage renewal rates

Mortgage renewal rates vary massively from lender to lender.

The rate that your current lender will offer you will be closer to the rates that they offer new clients rather than their cheaper discount rates they offer to existing customers. You should treat the first quote as the starting point for negotiation. If you’ve already spoken to other lenders and understand your switching costs, you will already know what options are available. At this stage, you can use this knowledge to your advantage.

For example, you might convince a new lender to waive administrative fees and cover the cost of a home appraisal in exchange for switching away from your current lender. Alternatively, you could show your current lender that another lender is offering more favourable terms. This can encourage the current lender to match or beat the competing offer.

If you take this path, ask the new lender for a rate hold. A rate hold is when the lender holds your rate for you for a period of time (up to 120 days) while you negotiate with your current lender. A rate hold is free, will protect you against rate increases while you negotiate with your current lender. Typically a rate hold will also still give you access to lower rates if interest rates drop during the rate hold period. So there is really no downside to asking for a rate hold, other than the additional paperwork required.

Mortgage renewal strategies to save you time, money and stress

Here are 10 mortgage renewal strategies that will save you time, money and stress.

1. Start your mortgage renewal early

It is best to start your mortgage renewal 4 – 6 months before the time when your mortgage is up for renewal. During this period of time, we would suggest contacting a mortgage broker who will shop around on your behalf to find the best possible mortgage for you. Once you have all of your options on the table and a thorough understanding of the costs involved with each option, you can then contact your current lender and see if they will be able to match the rate offered by the new lender.

Any negotiation with your current lender will involve multiple conversations and require approval from higher ups in the lenders organization. This is why you should leave a good amount of time, so that you are not rushed into a bad decision.

2. Review your mortgage needs

When it comes to money, it is best to be intentional about your financial decisions.

For example, imagine you currently live in a two-bedroom condo but plan to upgrade to a detached home in about 10 years. In this case, you might choose to either sell your condo in 10 years time so as to get the downpayment for a new home. Alternatively, it may make more financial sense to keep your condo, turn this into a rental unit and use a Home Equity Line of Credit (HELOC) to finance the down payment on the larger home.

In this case, at your five year renewal, it could make more sense to take a shorter amortization period, which would increase your monthly payments, allowing you to aggressively build equity during the second five-year term. Then, in 10 years time, you will have a lot more equity to put towards a downpayment on a larger home.

You also can do some general estimating of future mortgage costs by using a mortgage affordability calculator.

3. Understand switching cost

If you decide to go with a new lender, there will most likely be fees charged by both your current lender and your new lender. The current lender may charge discharge fees, legal fees, or prepayment penalties to release your mortgage. Meanwhile, the new lender may charge for a home appraisal, legal setup, and other administrative costs to register the new mortgage. These costs are collectively known as “switching costs”.

Whilst the new lender may waive certain fees in order to win your business, it is unlikely that your current lender will waive their switching costs. That said, it may make more sense to pay these upfront fees to secure a lower interest rate. For example, on a $500,000 mortgage amortized over 20 years, a 1% lower interest rate can save you $50,000 or more in interest.

4. Use prepayments to reduce your principal before you renew

If you have been on a low interest rate mortgage and market rates are now higher, you will still be able to keep low monthly payments by making a large prepayment when your mortgage renews. You will of course need to have the financial resources to do this and, it should make sense within the context of your overall financial goals. However, making a large lump sum pre-payment against your principle can significantly lower the amount of interest you will need to pay.

5. Consider re-amortizing your mortgage

Another way to reduce your monthly payments is to extend your amortization at renewal. For example, if you have 20 years remaining on your mortgage, you may choose to reset it to 25 years. This will lower your monthly payments, but it also increases the total interest you pay over time and ultimately raises the overall cost of the mortgage.

To put this into perspective, re-amortizing a mortgage to 25 years at a 5% interest rate instead of keeping a 20-year amortization at the same rate can cost approximately $17,000 in additional interest for every $100,000 borrowed over the life of the mortgage.

That said, if you are cash-constrained, extending your amortization may still make sense as a short-term strategy to improve monthly cash flow.

6. Consider fixed vs variable rates

Fixed interest rates tend to be higher than variable rates because the lender is taking on more risk. With a fixed-rate mortgage, the lender guarantees your interest rate for the entire term, even if market rates rise. To compensate for this uncertainty, lenders build a risk premium into fixed rates. Variable rates, on the other hand, fluctuate with the market, shifting more of the interest rate risk onto the borrower, which is why they usually start lower.

If you have a stable income and can tolerate the possibility of higher monthly payments, a variable rate may make more sense, as it often results in lower interest costs over time and offers greater flexibility if rates fall or if you need to break the mortgage early.

7. Use a mortgage broker

A mortgage broker works on your behalf to find the best mortgage options and available rates. Normally, your current lender will quote you a rate that is not their best rate whereas, other online rates are often higher than advertised. The truth is, available rates will normally be closer to the low rates that you see advertised online.

A mortgage broker will fill in the paperwork for each lender on your behalf. This is helpful because applying to multiple lenders individually can result in multiple credit checks. Each credit check can slightly lower your credit score, especially if they are spread out over time. And, with a lower credit score, you may face higher interest rates, less favorable mortgage terms, or even difficulty qualifying for certain lenders.

8. Negotiate for a better interest rate

Your current lender knows that re-qualifying with a new lender can be a hassle. As a result, they will often offer the highest rate they believe you will accept. Being prepared with an alternative allows you to know in advance what rate you are willing to accept from your existing lender. Should the rate from your current lender be higher than your alternative, simply present the details of the other offer and ask if they can improve on their initial proposal. If your current lender is unwilling to budge, the decision is yours: you can either remain with your current lender or switch to a new lender with a better rate and terms.

9. Consider debt consolidation

If you have existing debt that incurs a higher rate of interest than your mortgage, for example car loans, credit card bills, pay day loans and so on, it might make sense to consolidate this debt into your lower rate mortgage. This is not a “cure all” for debt, but it can help reduce your total monthly debt payments, so that you have more left over for savings each month. This method works best for disciplined borrowers who want to lower costs and are committed to avoiding new high-interest debt.

What happens if your current lender refuses to renew your mortgage?

It is important to remember that lenders want to renew your mortgage with you, because they earn a significant amount of interest over the life of the loan and it is far cheaper for them to keep an existing client than to acquire a new one. This means that if you kept up to date on your mortgage payments and have had no substantial change to your income, the lender will most likely renew with you.

That being said, if you have fallen behind on payments, or lost your job, the lender may choose not to renew your mortgage with you. B-lenders work with borrowers who don’t meet traditional lending criteria, often due to credit issues, irregular income, or temporary financial setbacks.

Since B-lenders work with borrowers who are perceived to be higher risk, they typically charge higher interest rates than the Big Six Canadian banks. They may also charge higher fees for mortgage setup, renewals, and administration, reflecting the additional risk and flexibility involved. However, B-lenders are generally intended to be short-term financial solutions while you stabilize your finances, rebuild your credit, or improve your income profile, with the goal of eventually qualifying for an A-lender at a lower cost once your mortgage term expires.

If a B-lender will not renew your mortgage, then you might have to work with a private lender. In this case, the qualification criteria will likely be substantially less strict but, rates and fees are likely to be much higher.

Final remarks

If your mortgage is up for renewal, this represents an opportunity to review your current financial situation, compare rates, and search for a more favourable set of terms. In order to best position yourself, you should take the time to understand the mortgage renewal process, what costs you are likely to incur and speak to a mortgage broker before engaging with your current lender.

If you start the mortgage renewal process 4 – 6 months before the renewal deadline, you will have ample time to consider your different options and get the best possible rate and set of terms for you.