Buying a first home in Canada has become increasingly difficult as property prices rise faster than incomes.

To help ease this challenge, in 2023 the Government of Canada introduced the First Home Savings Account (FHSA). This program was designed to make it easier for first-time buyers to save for a down payment through tax advantages and flexible savings options.

In this article, we’ll explain:

- What is the FHSA?

- What are the eligibility requirements for a FHSA?

- How much can I contribute to my FHSA?

- What are the key features of a FHSA?

- What are the pros and cons of a FHSA?

- HBP vs FHSA: How does the FHSA compare?

- Which financial institutions offer the FHSA?

Our goal is to give you a clear, easy-to-understand overview so you can decide if opening an FHSA fits your financial goals. For more technical or legal details, you can refer to the official Government of Canada guide on the FHSA.

What is the FHSA?

The FHSA (First Home Savings Account) is a registered investment account designed to help first-time buyers save for a down payment faster. It does this by allowing you to deduct your contributions from your taxable income, reducing the amount of tax you pay each year, while also letting your savings grow tax-free until you’re ready to buy your first home.

What are the eligibility requirements for a FHSA?

The Government of Canada defines the criteria for who is eligible for a First Home Savings Account. The criteria include.

- You must be a resident of Canada (Permanent Resident or Canadian Citizen)

- You must be 18 years of age (or the age of majority in your province) and 71 years or younger on December 31 of the year you open the account.

- You must be a first-time home buyer for the purpose of the account — meaning neither you nor your spouse or common-law partner owned and lived in a “qualifying home” in the current calendar year or in the previous four calendar years.

- You must have a valid Social Insurance Number (SIN).

Note

Most Canadians and permanent residents meet this requirement automatically. However, if you are a permanent resident (PR) and still have a SIN starting with “9,” this indicates that your SIN is temporary. In this case, you should contact Service Canada to have it updated once your status changes. Otherwise, you might face issues with contribution tracking or CRA eligibility later on.

How much can I contribute to my FHSA?

You can contribute up to $8,000 per year to your FHSA, with a lifetime maximum of $40,000.

If you don’t use your full $8,000 contribution room in a given year, the unused amount carries forward, allowing you to contribute up to $16,000 in a future year (your $8,000 annual limit plus up to $8,000 carried forward). However, you can never contribute more than $8,000 in new contributions per calendar year, regardless of your unused room.

The examples below make this very clear.

Example 1:

If you open your FHSA in 2024 but don’t contribute that year, in 2025 you can contribute up to $16,000 ($8,000 for 2025 + $8,000 carried forward from 2024).

Example 2:

If you contribute $5,000 in 2024, you’ll have $3,000 in unused room. In 2025, you can contribute up to $11,000 ($8,000 annual limit + $3,000 carry forward).

Your total lifetime contributions across all FHSAs cannot exceed $40,000, even if you have unused room remaining.

Buyers Tip

What are the key features of a FHSA?

In addition to the contribution limits of $8,000 per year (up to $40,000 total), there are several other key features that make the FHSA specifically geared toward first-time Canadian home buyers:

- Tax-deductible contributions: Your deposits reduce your taxable income, helping you save on taxes each year.

- Tax-free growth: Interest, dividends, and investment gains earned inside the account are not taxed.

- Tax-free withdrawals: Funds can be withdrawn tax-free when used to buy your first qualifying home in Canada.

- Carry-forward room: Unused contribution room (up to $8,000) can be carried forward to the next year.

- Limited lifespan: The account can stay open for up to 15 years, or until the end of the year you turn 71.

- Transfer flexibility: If you don’t buy a home, your savings can be transferred tax-free to your RRSP or RRIF.

- Eligibility: Available to Canadian residents aged 18–71 who haven’t owned and lived in a home within the past four calendar years.

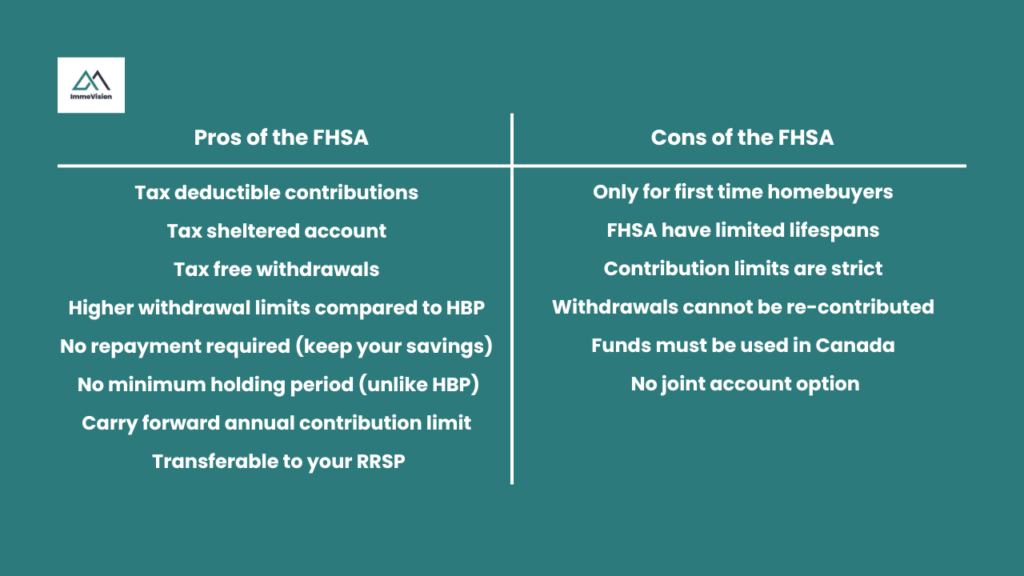

What are the pros and cons of a FHSA?

From a financial planning perspective, the pros and cons of opening an FHSA depend on your overall goals and cash flow priorities. The FHSA is most effective when your short- to medium-term goal is to buy a first home, and less so if your funds may be needed for other purposes.

In evaluating whether an FHSA makes sense for you, it’s important to compare it against alternative uses of your money such as contributing to a TFSA, RRSP, or paying down debt. This will allow you to see which option aligns best with your financial plan.

The table below summarizes the main advantages and drawbacks of the FHSA to help you make an informed decision.

For a complete discussion on the pros and cons of opening a FHSA and to decide if it is worth it for you, check our our article “First-time homebuyers: the pros and cons of the FHSA”.

HBP vs FHSA: How does the FHSA compare?

In Canada, the First Home Savings Account (FHSA) is most often compared against the Home Buyers’ Plan (HBP). This is because both solutions are designed to help first time buyers save for a home. However, they work in very different ways.

The HBP lets you borrow from your existing RRSP savings, while the FHSA helps you build new savings that grow tax free. The table below outlines the key differences between the two programs so you can see which option, or combination of both, best fits your home-buying strategy.

| Feature | FHSA (First Home Savings Account) | HBP (Home Buyers’ Plan) |

| Purpose | Help first-time buyers save for a down payment with tax advantages. | Allow RRSP holders to withdraw funds tax-free to buy a first home. |

| Eligibility | Must be a first-time home buyer and a Canadian resident aged 18–71. | Must be a first-time home buyer (or requalified) with funds in an RRSP. |

| Contribution Source | New, separate account with annual limit of $8,000 (lifetime $40,000). | Withdrawals from existing RRSP savings (up to $35,000 per person). |

| Tax Treatment of Contributions | Contributions are tax-deductible and grow tax-free. | Contributions to RRSP were already tax-deductible when made. |

| Tax Treatment of Withdrawals | Withdrawals for a qualifying home are completely tax-free. | Withdrawals are tax-free only if repaid to the RRSP within 15 years. |

| Repayment Requirement | No repayment required. | Must repay the withdrawn amount over 15 years (or pay tax on missed payments). |

| Account Lifespan | Can stay open for 15 years, or until end of year you turn 71 (which ever comes first). | RRSP is long-term and remains open indefinitely. |

| Transfer Options | Unused FHSA funds can be transferred tax-free to an RRSP or RRIF. | No transfer flexibility. Withdrawals must be repaid. |

| Best For | Buyers planning ahead who want tax-free growth on new savings. | Buyers who already have existing RRSP savings they can leverage. |

Buyers Tip

Which financial institutions offer the FHSA?

The FHSA is available for any Canadian citizen or Permanent Resident. However, not all banks offer the FHSA. The following is a list of banks that do offer it, with links to their programs.

- RBC Royal Bank — Offers an FHSA you can open online, with full investment product access.

- CIBC — Provides both advisor-assisted and self-directed FHSA options (GICs, mutual funds, stocks/ETS) through CIBC branches and CIBC Investor’s Edge.

- TD Canada Trust — Publishes an FHSA product that supports cash, GICs and mutual funds.

- BMO Financial Group — Has an FHSA available for opening online and supports multiple investment types.

- National Bank of Canada — Lists a full FHSA product including eligibility and how to open it.

- EQ Bank — Offers a digital-only FHSA (not available in Quebec at the time of writing) with cash and GIC options.