What is the OACIQ?

The OACIQ (Organisme d’autoréglementation du courtage immobilier du Québec) was created on May 1st 2010 with the sole mission to protect the public in real-estate transactions. It is a self regulated organization (SRO) that is mandated by the Quebec Government to regulate and enforce the Real Estate Brokerage Act. In effect, the OACIQ oversees the actions of all real estate brokers to protect the public.

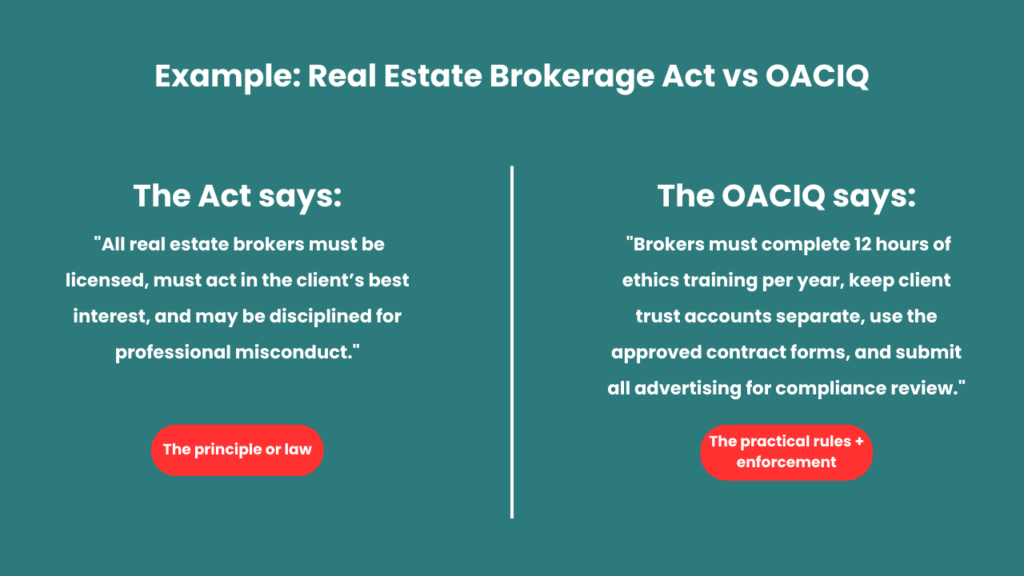

The Real Estate Brokerage Act sets out high level rules that brokers and agencies must follow. The OACIQ. translates these rules into practical details and enforces them.

What does the OACIQ do?

The OACIQ was created on May 1st 2010, it replaced the Association des courtiers et agents immobiliers du Québec (ACAIQ). Its primary purpose is to protect the public in real-estate transactions. To achieve this, the OACIQ:

- Regulates brokers and real-estate agencies, ensuring they operate according to the law.

- Sets and enforces professional and ethical standards for all licensed brokers.

- Issues and renews licences and oversees brokers’ continuing education to maintain competence.

- Investigates complaints from the public and takes disciplinary action when rules are broken.

- Provides financial compensation to consumers who suffer losses due to broker fraud, negligence, or errors.

How to file a complaint with the OACIQ?

To file a compliant with the OACIQ, you must first document details of your complaint. To do this, open up a word doc, google doc, or whatever is your preferred note taker and write down what you are complaining about.

Once you have documented the reason for your complaint, attach your document and send it to [email protected]. They will direct you to the appropriate department, depending on the issue.

The office is open Monday, Tuesday, Thursday and Friday from 9 am to 4 pm.

On Wednesdays, the office is open from 10 am to 4 pm.

If you have any other questions, they may be reached at the following phone number 450 462-9800 / 1-800-440-7170.

What is the OACIQ complaints process?

In Quebec, the OACIQ (Organisme d’autoréglementation du courtage immobilier du Québec) is the self-regulatory organization responsible for overseeing real estate brokers. It is empowered by the Real Estate Brokerage Act to license, regulate, and discipline brokers while protecting consumers. The OACIQ has several key components:

- Assistance Department (AD): This department is the one that receives your complaint. They will attempt to resolve disputes informally if possible. They assess the severity of the issue and may refer it to the Syndic or other departments. For instance, a minor misunderstanding or service complaint that can be clarified without formal disciplinary action.

- Syndic: If your complaint cannot be resolved informally, it will be escalated to the Syndic. This department investigates complaint and check if it violates either the Real Estate Brokerage Act or OACIQ rules. They do this by gathering evidence and determining whether a formal complaint should be filed.

- Discipline Committee: The Discipline Committee will review cases referred by the Syndic and can impose penalties on brokers, including fines, mandatory training, or suspension/revocation of their licence.

- Financial compensation funds: The OACIQ administers the Real Estate Indemnity Fund (FICI) for losses caused by fraud or dishonest behavior, and the Financial Assistance Fund (FARCIQ) for losses resulting from unintentional errors, negligence, or omissions.

What are the most common complaints filed against realtors in Quebec?

At Immovision, we did a short study on the total number of active brokers who had one or more disciplinary actions in Quebec. We found that out of 17,000 brokers, 535 of these brokers had received one or more disciplinary actions from the OACIQ. This is ~3% of all brokers. These brokers still work for reputable firms, including RE/Max, Royal LePage, Groupe Sutton and many others.

Out of these 535 brokers, we found that the most common complaints included:

- Conflicts of interest / undisclosed dual agency / broker acting in their own favour

- Failure to properly disclose property condition or defects, or failure to ensure “sold without warranty” / improper warranty disclaimers

- Errors, omissions, or negligence in contract documentation or professional responsibility/co‑ordination, including failure to properly draft or submit required forms

- Submission of false or bogus offers / fraudulent bids / misleading the market (fraudulent tactics)

- Mismanagement or mishandling of funds / trust‑account irregularities / potential misappropriation of funds

Is it worth complaining to the OACIQ?

Yes – it is worth complaining to the OACIQ. The body does impose disciplinary action on brokers for violating rules in either the Brokerage Act or the OACIQ’s rule set.

However, depending on what your goals are with the complaint, there are different options open to you. For example, if your primary goal is to recover money fast, then direct negotiation with your broker or a small claims court may be a better options. This is because the OACIQ’s process can take months, and financial compensation depends on fund rules.

However, if you have suffered significant financial losses and the broker cannot compensate you, it is best to report the issue to the OACIQ. This is because the OACIQ has access to the FICI and FARCIQ fund that may have the resources to provide financial assistance. Furthermore, even if you don’t get money back, it can result in professional consequences for the broker and may help prevent the same issue for others.

What are the penalties for violating the OACIQ rules?

Penalties for violating OACIQ rules depend on the seriousness of the violation and are imposed by the Discipline Committee after an investigation. They can include:

- Fines: Monetary fines for infractions, ranging from hundreds to several thousands of dollars depending on severity.

- Mandatory courses or training: The broker may be required to complete specific professional development or ethics courses to correct their behavior.

- Suspension of licence: The broker can have their licence temporarily suspended, preventing them from legally practicing for a set period.

- Revocation of licence: In severe cases, the broker’s licence can be permanently revoked, ending their ability to practice in Quebec.

- Orders to make restitution: While the Discipline Committee itself doesn’t pay the client, it can order the broker to compensate a client for losses, which may then be claimed through the FICI or FARCIQ funds if the broker cannot afford to pay or cannot be found.