For most Quebec homeowners, the property tax bill is one of the biggest annual expenses and also one of the least understood. In this article, we’ll unpack everything you need to know about property taxes in Quebec. More specifically we will cover

- What is property tax?

- How is property tax calculated?

- What does property tax pay for?

- How does property tax impact home prices?

What is property tax?

Property tax is an annual fee that homeowners pay to fund local public services. In other words, it is how homeowners contribute financially to their community.

In Quebec, property tax has two main components: municipal tax and school tax. Your municipality collects municipal tax to pay for services like road maintenance, garbage collection, police, and fire protection. Meanwhile, your local school service centre (CSS) collects school tax to fund the public education system. As a homeowner, you will receive two separate property tax bills each year: one for municipal tax and one for school tax.

How is property tax calculated?

Property taxes for residential properties are based on three things. These are the assessed value of your property, the municipal tax rate set by your city, and the provincial school tax rate, which is standardized across Quebec. These three components are visible in the property tax formula:

Property Tax = (Assessed Value × Municipal Tax Rate) + (Assessed Value × School Tax Rate)

Let’s break this down, first looking at the properties assessed value.

1. Find your properties assessed value

Depending on where you live, it is either the municipality or your urban agglomeration that determines the assessed value of your property. This is done through an assessment roll and is usually updated every three years.

The assessed value is what the municipality estimates your home and land are worth. Assessed value, is not the same as the value calculated during a home appraisal, a brokers Comparative Market Analysis (CMA) or what you paid for your home. You can find your properties assessed value by searching your address on your city’s website. Links for these are included below.

- Montreal Property Assessment Roll

- Longueuil Land Assessment Roll

- Laval Land Assessment Roll

- Brossard Land Assessment Roll

For example, if you live in Greater Montreal, the City of Montreal’s Property Assessment Department prepares new assessment rolls for all 16 municipalities in the City of Montreal. To find your property, you must first check the Montreal Land Assessment Roll.

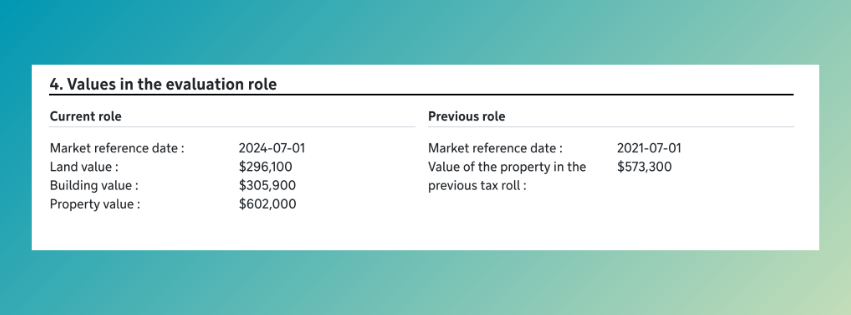

Next, choose the online service and then enter the address of your property and click through the forms. On the final page of your search, you will find the “Values in the evaluation role” (screenshot below).

As you can see, this includes market reference date, land value, building value, value of the building and the value in the last assessment role. The land value is the value of the land that your property is built on. The building value is the value of the building on the land. The value of the building is the building value plus the land value. So, in the example below, the total assessed value is $602,000 and this was assessed on 2024-07-01, meaning that it is valid until 2027-06-30.

2. Find your municipal tax rate

Now that you know your property’s assessed value, the next step is to find your municipal tax rate. This is where things get a bit more complicated. Most municipalities in Quebec set their own local municipal tax rates. However, if the municipality is part of an urban agglomeration, the central city (for example, Montréal or Longueuil) sets an agglomeration tax rate for shared regional services.

There’s one exception: if the municipality has reconstituted (become independent again after the municipal mergers), it can set its own local tax rate while still contributing to the agglomeration through a separate regional portion.

This means that if you live in a reconstituted municipality, your total municipal tax rate is made up of two parts:

- A local municipal tax rate (e.g., set by Beaconsfield City Council)

- An agglomeration tax rate (e.g., set by the City of Montreal)

To find your current tax rate, visit the City of Montreal tax rate page and, if you live in a reconstituted municipality, check the rate on your city’s website directly.

- Beaconsfield municipal tax rate

- Westmount municipal tax rate

- Dorval municipal tax rate

- Côte-Saint-Luc municipal tax rate

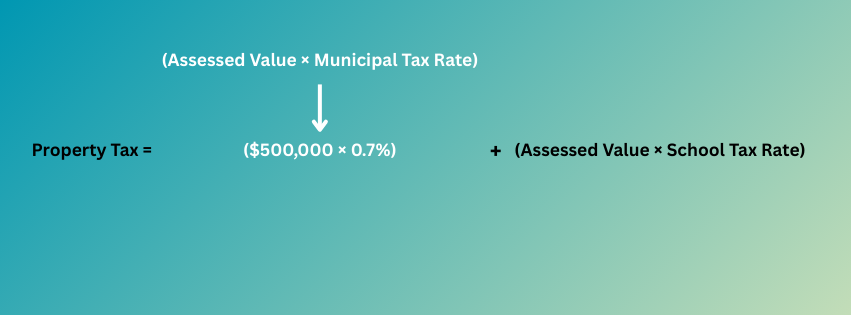

Once you have your municipal tax rate, just plug the values into the municipal half of the property tax formula. For instance, if your assessed value is $500,000 and your cities municipal tax rate is 0.7%, then your municipal tax is $500,000 × 0.007 = $3,500.

3. Check the school tax rate

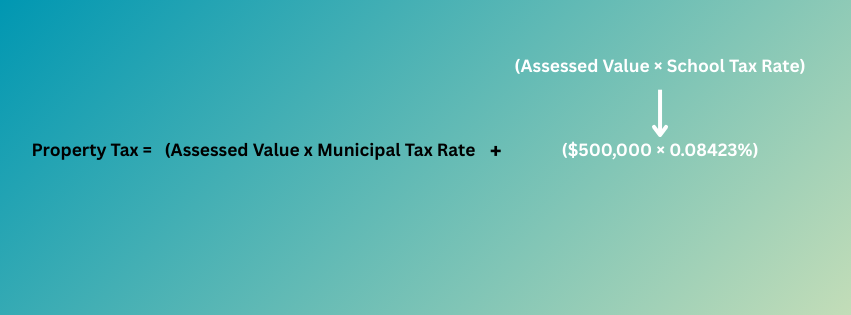

Quebec has a single standardized school tax rate for everyone living in Quebec. This is currently 0.08423% for 2025–2026. To calculate your school tax rate, simply plug the values into the school tax section of the property tax formula. Continuing our example, this is $500,000 × 0.0008423 = $421.15

4. Add both amounts

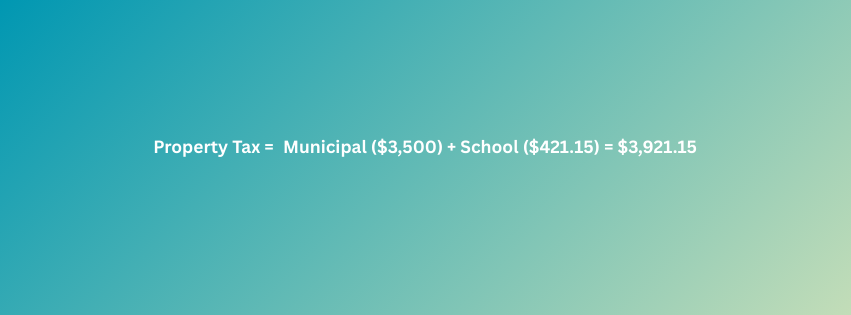

If you revisit the property tax formula, you will see that the final step is to add the municipal amount together with the school tax amount. This is shown below.

5. The payment schedule

Now you know how property tax is calculated and what the total amount of property tax that you have to pay is. The next step is to determine the payment schedule. This is normally broken into two charges.

The municipal tax is normally paid in the first half of the year, with most cities issuing the bill in January or February and setting due dates in March and June. Whereas the school tax is typically paid between July and August, covering the period from July 1 to June 30 of the following year.

What does property tax pay for?

Property taxes are the lifeblood of local government services and infrastructure. In Montreal and elsewhere in Quebec, those funds go toward things like:

- Maintaining, repairing, or replacing roads, bridges, sidewalks, and underground infrastructure (water, sewers, storm drains)

- Investing in public transit, bike lanes, and active transportation networks

- Building or upgrading community centres, libraries, recreation facilities, and green spaces

- Paying for local public works, street lighting, traffic signals, snow removal, parks, waste collection

- Supporting utilities, drainage management, flood mitigation

- Covering administrative costs to run municipal departments that coordinate these services

Examples of notable Montreal constructions in the last 24 months

The City of Montreal contributes to 30% of the construction work done in the city. It publishes a list of some of the most notable construction projects split by region (see image below).

On this page at the link, where you can see examples of notable Montreal construction projects in the last 24 months such as:

- A new bridge to connect Pont Jaques to Ile Bizard.

- The Namur-Hippodrome infrastructure

- Work Projects in Lachine

- Check out public works and major projects for more.

How does property tax impact home prices

Property taxes can impact house prices in several ways. For instance:

- Higher property taxes reduce what buyers can afford

- Strong public services can increase house prices

- Sudden tax increases can slow the housing market

- Stable prices support price predictability

Let’s dive into each of these topics, as we consider how do property taxes impact house prices.

1. Higher property taxes reduce what buyers can afford

When assessing how affordable a home is, both buyers and lenders consider the total monthly cost of owning the property. Property taxes are one of the largest ongoing expenses, alongside mortgage payments, insurance and utilities. Lenders factor these costs directly into the affordability calculations using the Gross Debt Service (GDS) and Total Debt Service (TDS) ratios.

Because property taxes count toward GDS and TDS, higher taxes reduce the amount a buyer can borrow. For example, an additional $1,000 per year in property taxes can lower mortgage affordability by roughly $20,000–$25,000, depending on interest rates. Over time, this puts downward pressure on home prices in high-tax areas, as both buyers and lenders adjust purchase budgets to account for higher ongoing costs of property ownership.

2. Strong public services can increase house prices

High property taxes aren’t always bad for property values. If those taxes are visibly used for better schools, safer streets, good infrastructure, well-maintained parks and so on, they can actually support or raise home values.

For instance, neighbourhoods with well-rated public schools and modern infrastructure often attract families, even if taxes are higher. This is because buyers see these areas as offering better long-term value and quality of life. So in practice, whilst high taxes and low quality services can reduce property prices, high taxes and high quality of services can actually improve property prices.

3. Sudden tax increases can suddenly slow markets

If you are a real-estate investor, you already know that sudden tax increases can slow markets. This is because homeowners feel the financial squeeze and new buyers cannot afford to get into the market. Furthermore, pressure to sell among highly leveraged homeowners can lead to fire-sale conditions. This is something that we saw in Toronto in 2025, when the City of Toronto raised residential property tax rates by ~6.9 %.

4. Stable prices support price predictability

Buyers and investors value stability. Municipalities with predictable tax policy tend to see more stable home prices over time because buyers can plan their budgets confidently. In contrast, regions with sudden or inconsistent tax hikes often see more volatility in both sales and property prices.

Final remarks

Property taxes are one of the largest annual expenses that homeowners in Quebec must pay. These taxes aren’t just numbers on a bill that comes in the mail. They reflect how a city funds its schools, infrastructure, and public services. Put another way, it is how homeowners invest in their municipality.